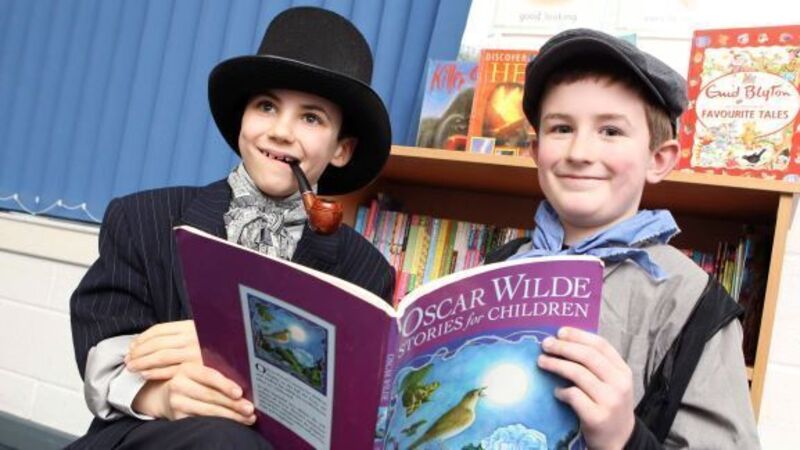

Young eager readers turn over a new leaf

The country’s 510,000 primary pupils have each been given a token to pick up any one of nine titles written to celebrate World Book Day in Ireland yesterday. And to mark the occasion, the €1.50 token can alternatively be used until Mar 24 towards any book or audio book costing €3.99 or more at participating bookshops.

While audiobooks are making a mark on the children’s market, Irish booksellers say the printed versions are certainly not going out of fashion.