Irish eyes on UK beef market share

Ireland is now set to compete for UK beef market share after a free trade deal was established between Australia and the UK. File Picture.

Australia will become a new competitor for Ireland in the 270,000 tonnes of beef per year UK import market, following the UK recently agreeing to a Free Trade Agreement with Australia.

However, it will be late 2022, at the earliest, before the trade deal is likely to be approved by the UK’s parliament.

Some details of the deal released by the Australian Prime Minister indicate that Australia will have immediate access to a duty-free quota of 35,000 tonnes of beef, rising in equal installments to 110,000 tonnes in Year 10.

In the subsequent five years, the volume threshold is expected to rise in equal installments to 170,000 tonnes, above which a tariff of 20% will apply.

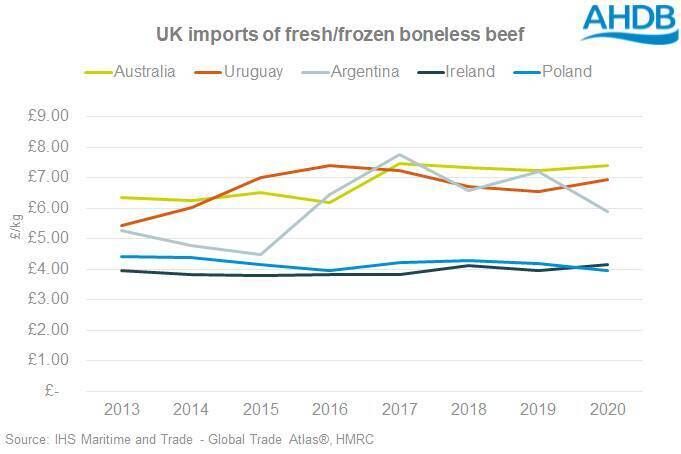

According to the UK’s Agriculture and Horticulture Development Board (AHDB), the current arrangement is that Australia has a quota for export to the EU (including the UK, until Brexit), while paying a 20% tariff rate.

This has resulted in the UK importing 2,500-3,000 tonnes of beef from Australia, down from more than 7,000 tonnes in 2013 and 2014.

Beef imported from Australia is more likely to be higher value steaks, and at the moment, the import price for this Australian beef in the UK is higher than beef from South America and much higher than beef from the EU (see accompanying chart).

However, part of the reason the EU beef price landed in the UK is much lower is because it includes a wider range of boneless products, including for example mince (which helps to explain why the Irish price is the lowest).

Currently, better markets nearer to home are also preventing significant volumes of Australian beef from coming on the UK market.

Australia can export its steaks and other boneless beef cuts for an average of £6,500 a tonne to markets such as Japan, China, South Korea, Indonesia as well as the United States, rather than try to match the UK average import price of around £5,000 a tonne.

These markets are much more attractive to Australian beef exporters at a time when the Australian beef industry is emerging from a period of extended drought and does not have as much beef to export as it had previously.

This lack of supply has pushed up the price of Australian beef cattle.

The Australian Bureau of Agricultural and Resource Economics and Sciences forecasts beef and veal export volumes to increase by 16% in 2021/2022.

Nevertheless, Australia's relatively large farms tend to have much lower costs of production than those in the EU, making it a relatively competitive beef, sheep, and dairy exporter.

According to the AHDB, it is the Australia trade deal's erosion of value in the premium tier of cuts that concerns the UK beef sector.

This must be a concern also for Irish exporters, the main suppliers to the UK, that Australian imports could drag down the relatively high price of steaks in the UK, and thus the average beef price.

The potential volumes from Australia over the coming decades could act as a price ceiling in the UK market for some cuts.

And that effect will be multiplied if, as expected, more major trade deals are signed by the UK.

Their agreement with Australia is the first genuinely new post-Brexit trade deal, and the United States and New Zealand are probably next in the pipeline, according to the AHDB.

All such deals will bring UK prices closer to world prices, and could eventually make the UK beef market much less rewarding for Irish exporters.