Nvidia boss dispels fears AI chips output will lag demand

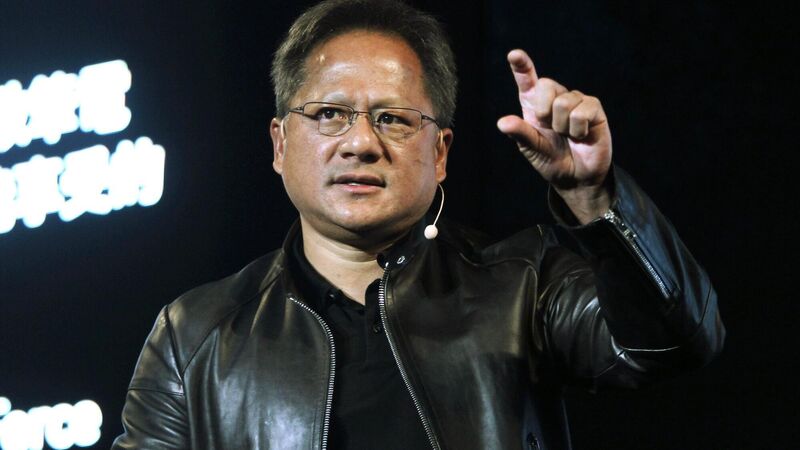

Nvidia CEO Jensen Huang said: “We’re focused on increasing our supply.”

Nvidia chief executive Jensen Huang, fresh off an upbeat quarterly report that sent his company’s shares soaring, dispelled one of investors’ biggest concerns: That chip production won’t keep up with demand.

Though Nvidia didn’t give long-term projections, Mr Huang said that supply will “substantially increase for the rest of this year and next year”. The company relies on vendors such as Taiwan Semiconductor Manufacturing and Samsung Electronics for components, and a lack of adequate inventory was seen as a challenge to its growth run.