Scammers using fake Irish celebrity endorsements to target over 50s trying to top up retirement funds

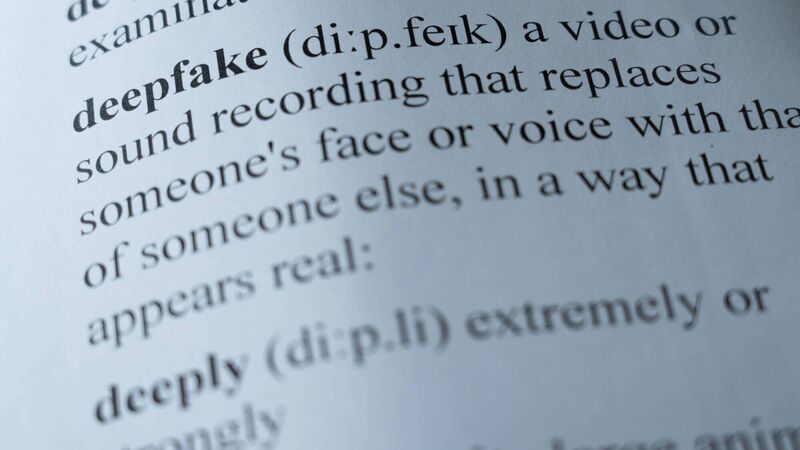

This is a generic image of a deepfake definition. See PA Feature LIFE Scam. WARNING: This picture must only be used to accompany PA Feature LIFE Scam. PA Photo. Picture credit should read: Alamy/PA. NOTE TO EDITORS: This picture must only be used to accompany PA Feature LIFE Scam.

A rising wave of deepfake ads using AI to impersonate Irish celebrities are being used to target and scam consumers, with average losses ranging between €30,000 to €40,000 for those getting duped.

The past three months have seen a surge in investment fraud cases reported to the gardaí, ranging from small-scale cryptocurrency scams to larger investment-related fraud.