China car parts makers join Apple in offshore factory push as US trade tensions flare

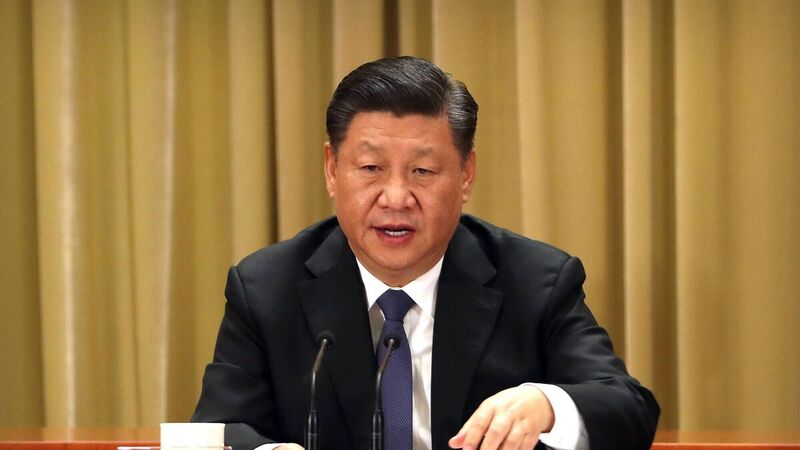

While some names like Airbus and Tesla are doubling down, the shift is an increasing threat to China’s status as the world’s factory and its bid to regain the trust of global business amid the unpredictability of president Xi Jinping’s rule.

Chinese car parts makers are facing growing pressure from overseas customers to set up factories outside the country as mounting trade tensions and three years of pandemic lockdowns make them wary of relying too heavily on China.

Carmakers from Europe and elsewhere are making direct overtures to manufacturers of everything from cooling components to brake systems and auto charging parts, pressing them to establish plants in places like Vietnam and Indonesia so they can still benefit from their expertise and long-held relationships but avoid the risks China poses right now.