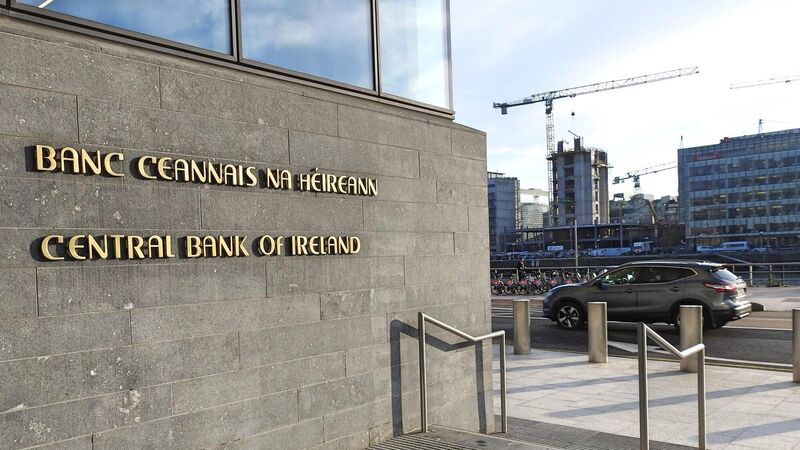

Central Bank outlines five key risks for consumers in 2023

In its Consumer Protection Outlook Report for 2023, the Central Bank has outlined five key drivers of consumer risk, for consumers of financial services in Ireland.

Cybersecurity and developing technology, ineffective communication from financial services providers, and today’s changing economic landscape are all amongst the key risks highlighted by the Central Bank for consumers.

In its Consumer Protection Outlook Report for 2023, the Central Bank has outlined five key drivers of consumer risk, for consumers of financial services in Ireland.