Britain's Hunt delayed 'properly tough' budget decisions, says IFS think tank

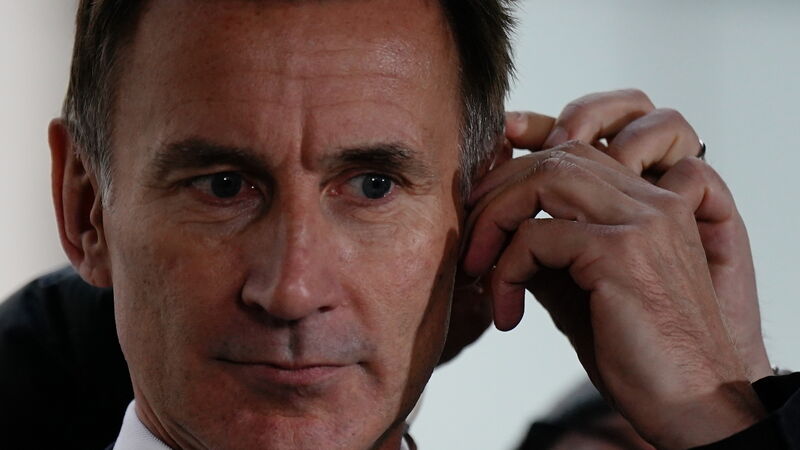

UK chancellor of the exchequer Jeremy Hunt: 'He may hope that things will look better by then, or perhaps that it will be somebody else's problem.'

British chancellor Jeremy Hunt appears to have delayed the "properly tough" decisions needed to balance the public finances, possibly in the hope of an economic upturn that will reduce the need for a painful squeeze, a think-tank has said.

"Hemmed in by rising interest payments and poor growth prospects, the chancellor decided to allow borrowing to rise, and to put off properly tough decisions for another couple of years," Paul Johnson, director of the Institute for Fiscal Studies, or IFS, said.