Somers warns Ireland's image is hit by bank exit; Ulster boss says she aims to minimise job losses

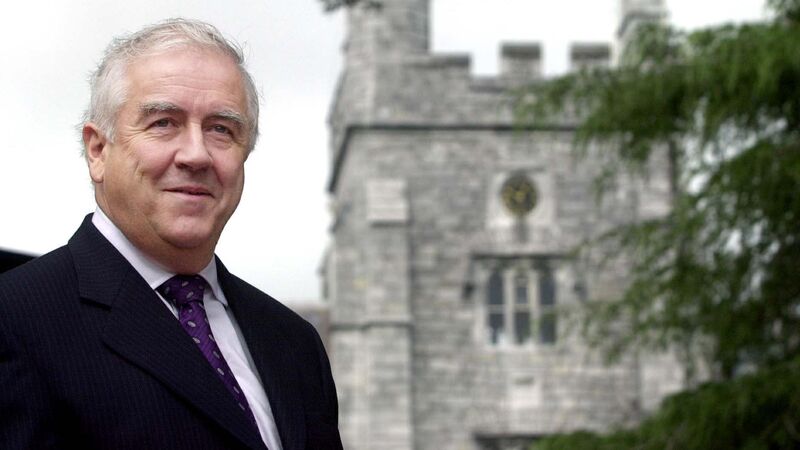

'The fact that a major bank like National Westminster with a significant subsidiary here for 160 years can’t make money sends out a strange question about the country.' said former NTMA chief Michael Somers. Picture: Denis Minihane

A former National Treasury Management Agency head Michael Somers, who helped set up the agency during the debt crisis of the late 1980s, said the decision of Britain’s NatWest to pull Ulster Bank from the market sends a negative message around the world about the costs of doing business in Ireland.

In an interview, Mr Somers — who is also a director at financial services firm Fexco, chairman of Goodbody, and a former non-executive director to the AIB board appointed by the government after the 2010 financial crash — said the image of Ireland as a location for international businesses to thrive has been badly harmed.