Central Bank promises not to lower standards amid simplification push

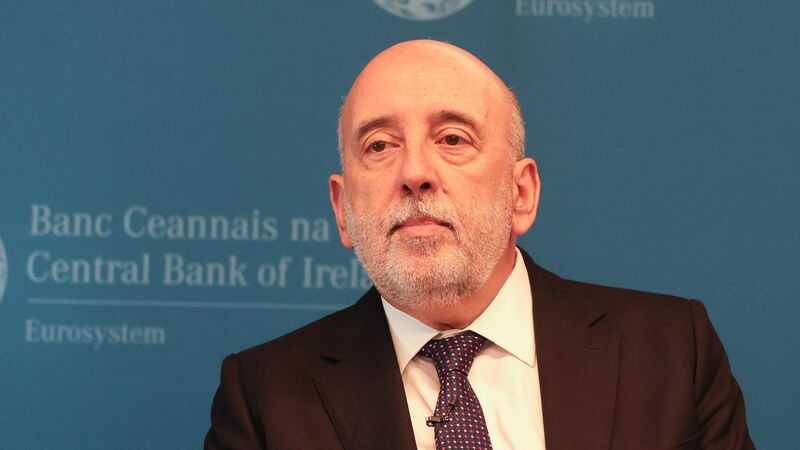

Central Bank of Ireland governor Gabriel Makhlouf said changes to the regulatory framework are not about “‘lowering standards” but rather “improving quality, coherence and clarity”.

The governor of the Central Bank has promised that the agency will not lower its standards when it comes to regulating the financial system as it outlines a new framework aimed at improving efficiency.

In its report, , the Central Bank outlined its simplification roadmap for the next three years as well as its new approach to a more efficient regulatory and supervisory framework.