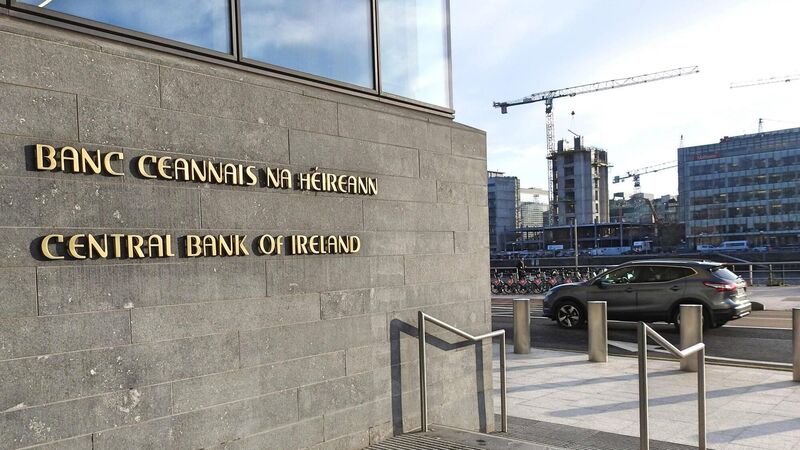

Central Bank fines credit union for breaches of anti-money laundering requirements

An investigation found Swilly Mulroy Credit Union operated a practice of soliciting and accepting cash from depositors who did not hold accounts with the credit union.

The Central Bank of Ireland has fined Donegal-based Swilly Mulroy Credit Union just over €36,000 for breaches of anti-money laundering requirements over a seven-year period.

Under the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010, firms are required to put in place safeguards against the risk of money laundering.

The Credit Union Act 1997 also requires credit unions to develop and implement risk-management systems to monitor and manage risks.

An investigation by the Central Bank found Swilly Mulroy operated a practice of soliciting and accepting cash from depositors who did not hold accounts with the credit union.

The bank said this money would then be electronically transferred to a branch of a local bank without first being deposited in an account in the customer’s name at Swilly Mulroy. This means the credit union failed to conduct the necessary anti-money-laundering checks on the depositors and the transactions.

“This specific cash-intensive practice had been flagged to the credit union sector as presenting a heightened money-laundering risk,” the Central Bank said.

The investigation found Swilly Mulroy operated this practice between January 2, 2014, and June 30, 2021, during which time it processed €8,751,694 in deposits from 2,329 cash lodgements.

“The board of Swilly Mulroy was aware of the risks associated with the practice from 2015 but failed to act on its risk management obligations under the 1997 act. A new management team ceased the practice in 2021 and subsequently brought it to the attention of the board,” the Central Bank said.

While the practice ceased in 2021, the issue was not brought to the attention of the Central Bank and was instead discovered in 2022 during an inspection by the bank’s anti-money-laundering division. The Central Bank commenced this enforcement investigation in 2023.

“The investigation yielded multiple examples of cash lodgements, which in the usual course should have triggered additional and careful scrutiny, but instead were processed without any anti-money-laundering checks,” the Central Bank said.

The credit union admitted to the prescribed contraventions and agreed to the undisputed facts as set out in the attached settlement notice.

As part of the settlement, Swilly Mulroy Credit Union received a reprimand and monetary penalty in the amount of €51,819, proportionate to the size of the firm.

However, a discount of 30% on the fine was applied as a result of the credit union agreeing to the settlement, bringing the final fine to €36,273.

The sanctions are subject to confirmation by the High Court and will not take effect unless confirmed.

Central Bank director of enforcement Colm Kincaid said anti-money-laundering and counter terrorist financing legislation was “designed to prevent the financial system being used to launder the proceeds of crime or fund terrorist activities”.

“One of its key safeguards is that regulated financial service providers have controls in place to identify their customers and detect potential money laundering or terrorist financing.”

This is the Central Bank’s 160th enforcement outcome to date, bringing the total fines imposed by the Central Bank to more than €407m.