UK's Rightmove to consider latest buyout offer from Murdoch-controlled property site

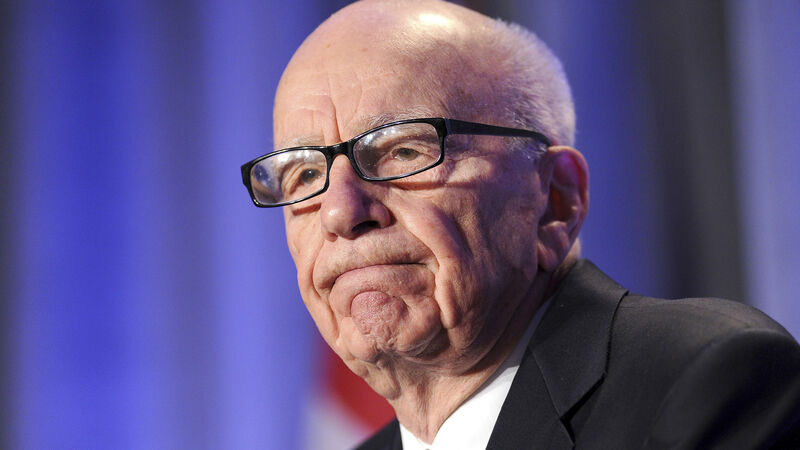

The REA Group is controlled by Rupert Murdoch through News Corp.

UK real estate website Rightmove has said it will consider a £6.1bn (€7.3bn) sweetened bid from REA Group — the third proposal in less than three weeks from the Australian property portal.

The offer stands 2.8% higher than a previous bid by REA, which is part of media mogul Rupert Murdoch’s empire. REA had expressed frustration at the UK firm’s refusal to even discuss a deal after rejecting its two previous offers.