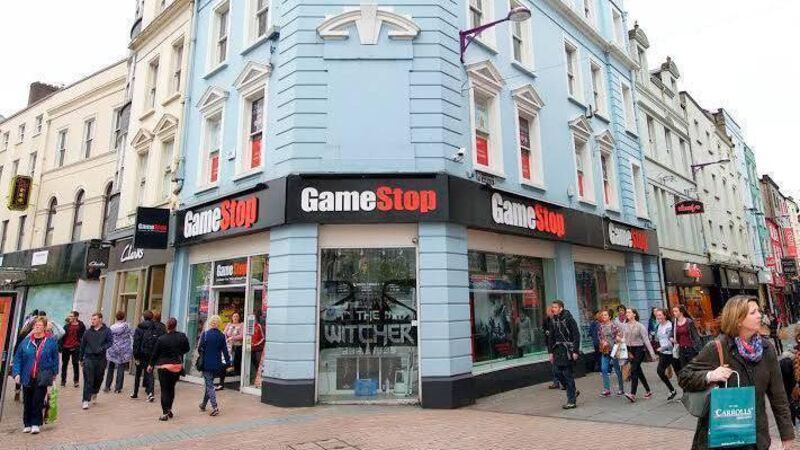

GameStop share-buying spree ends in flop after week of stocks frenzy

GameStop has filed for a mixed-shelf offering, where it can raise capital by selling different securities in separate offerings.

Retail darling GameStop slumped 24% on Friday, after the struggling videogame retailer said it would sell up to 45m shares, taking advantage of the meme stocks frenzy that took hold this week.

The Texas-based firm logged its highest trading volume in three years this week, following a series of posts from Keith Gill's X account "Roaring Kitty", whose bullish calls on GameStop were a reason for the 2021 meme-stock frenzy.