Boeing faces big questions over deliveries of Max planes

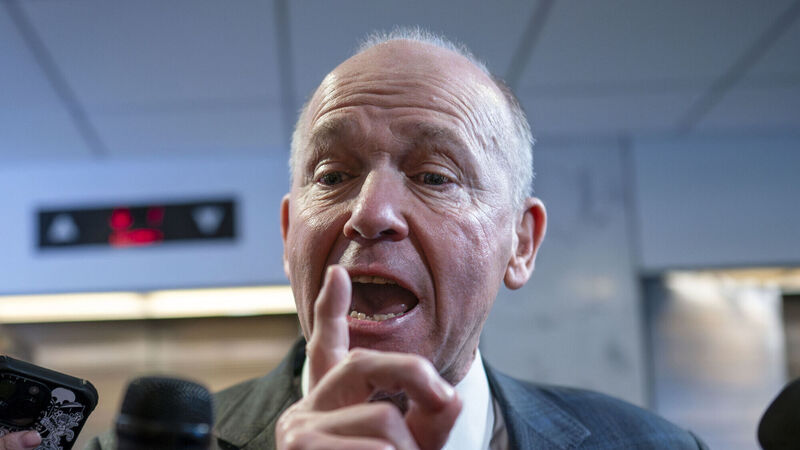

The blowout has led to a management shake-up with investors keen to see who will take over from CEO Dave Calhoun. Picture: AP/J. Scott Applewhite

Tough questions await Boeing when it announces its results on Wednesday, including on potential chief executive candidates, talks with Spirit AeroSystems, and slumping 737 Max jet output, while its quarterly report is expected to show a surge in cash-burn rate.

The US plane maker, which is reeling from a safety crisis sparked by a mid-air door plug blowout on a 737 Max 9 jet in the US on January 5, is also expected to report its first revenue fall in seven quarters.