Irish-founded Stripe valuation rebounds to $65bn following tender offer

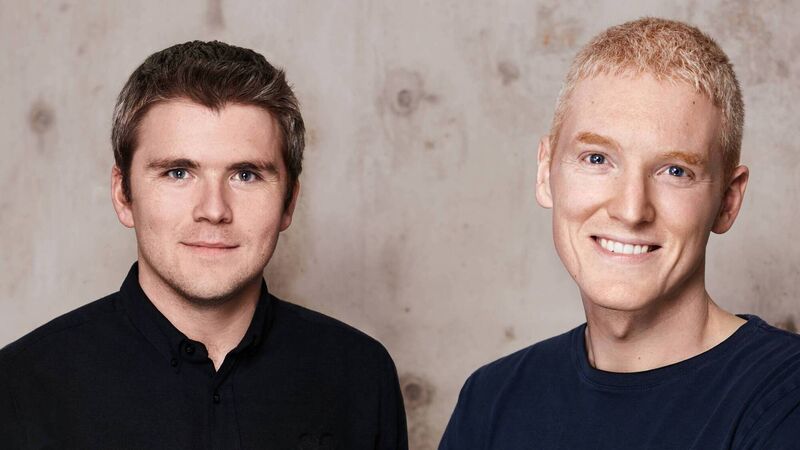

Stripe was founded in 2010 by Limerick brothers Patrick and John Collison.

The valuation of global payment processing firm Stripe rebounded to $65bn (€60bn) after it entered into a share repurchasing agreement.

The tender offer which provides current and former Stripe employees with liquidity has boosted Stripe’s valuation but it still remains below the €95bn peak it hit in the e-commerce boom in the midst of the pandemic.