AI demand faces test as chip maker Nvidia prepares to unveil earnings

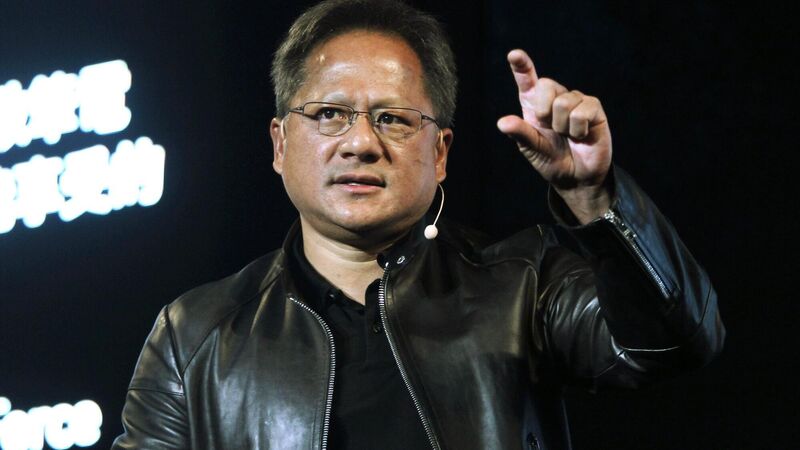

Nvidia chief executive Jensen Huang: Analysts said Nvidia is able to meet only half the demand and its H100 chip is selling for double its original price of $20,000.

Nvidia investors expect the chip designer to forecast quarterly revenue above estimates when it reports results on Wednesday. Their only question is, by how much?

The company has been the biggest beneficiary of the rise of ChatGPT and other generative artificial intelligence, or AI, apps, virtually all of which are powered by its graphics processors.