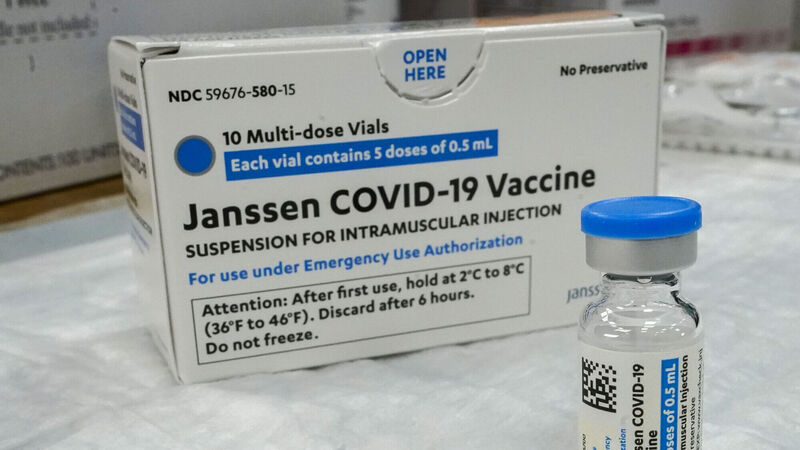

Johnson & Johnson cuts profit forecast as it suspends guidance for Covid vaccine sales

The future of vaccine sales has been a question mark among all makers of Covid shots as concern about the outbreak has waned in recent months.

Johnson & Johnson cut its annual profit forecast, citing currency exchange headwinds, and suspended guidance for Covid-19 vaccine sales even as first-quarter earnings beat analysts’ estimates.

Chief financial officer Joseph Wolk said the change was “exclusively” due to exchange rates that shaved $2.5bn (€2.3bn) off anticipated top-line growth for the year.