Hong Kong shares tumble

Hong Kong’s stocks fell for a third day on deepening concerns about the economic fallout from weeks of anti-government demonstrations that show no sign of easing.

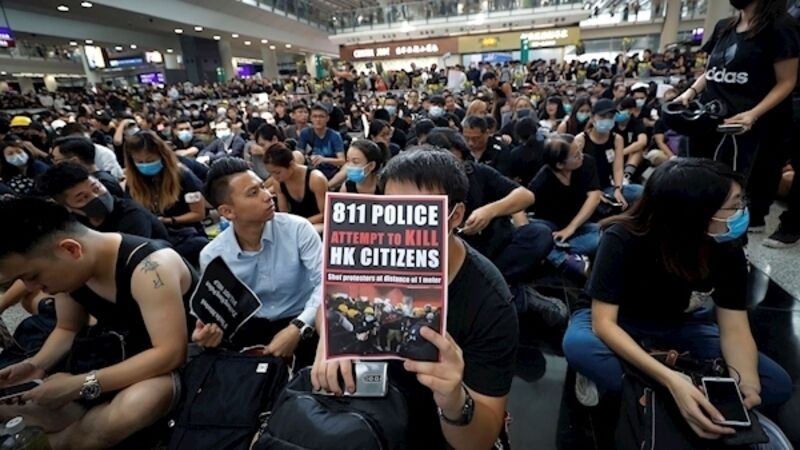

The city’s international airport was severely disrupted for a second straight day, as protesters blocked outgoing gates in a dramatic sit-in. Hong Kong’s embattled leader Carrie Lam warned that the Asian financial center risked sliding into “an abyss,” in a contentious news conference in which she continued to sidestep key questions about the government’s response to weeks of unrest.