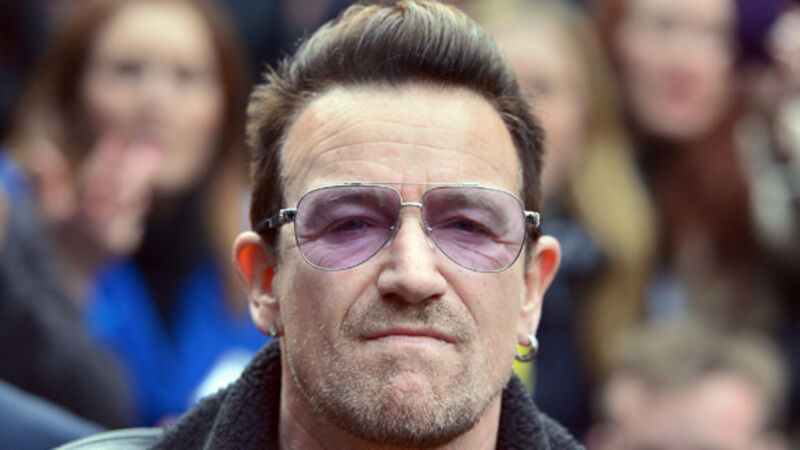

Loss at Bono’s clothing firm

New figures lodged with the Companies Office show that Edun Apparel Ltd recorded a loss of $6.3m last year, extending the losses of recent years.

Bono and his wife Ali established the global fashion brand in 2005 to bring about positive change through its trading relationship with Africa.