Officialdom must step back from Brexit scaremongering

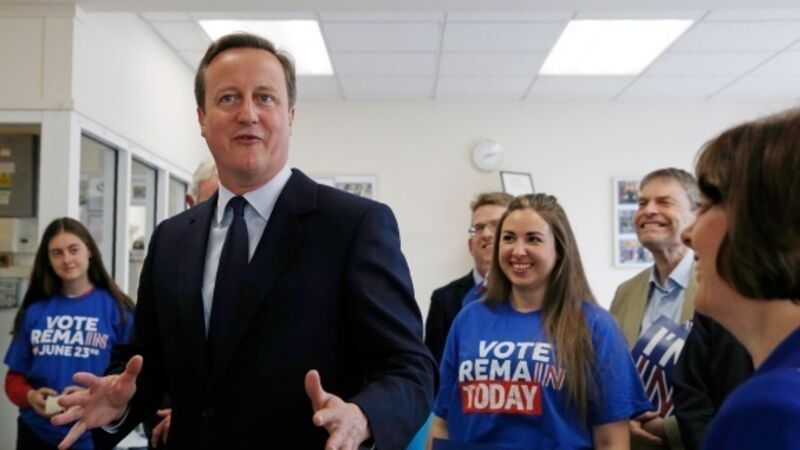

THE doomsday narrative of British prime minister David Cameron, the Bank of England, and their official friends around the world is setting a course for a self-fulfilling financial panic.

They insist that the British economy will be permanently poorer and global markets will be roiled if the British public votes to leave the EU in tomorrow’s referendum. These claims are based on fuzzy analysis. More seriously, they are deeply irresponsible. Make no mistake, if markets do panic it will be because of the hysteria that the officials have built up. To redeem themselves, policymakers around the world must set up visible signposts now to dampen financial turbulence.