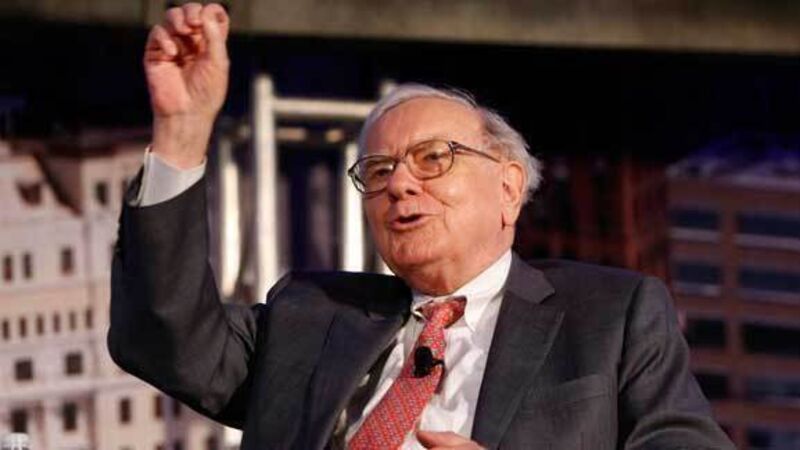

Warren Buffett discloses huge $1.1bn stake in Apple

Berkshire held 9.81m shares as of the end of March, a regulatory filing from the billionaire’s Omaha, Nebraska-based company showed.

The holding was valued at $1.07bn at the end of the first quarter.