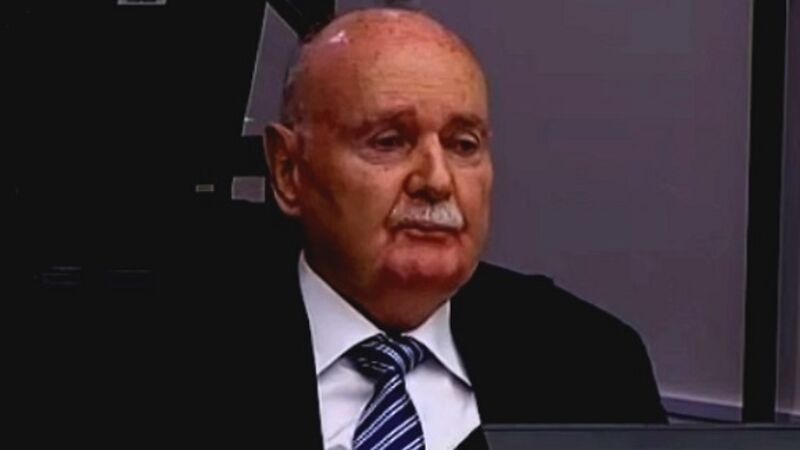

Michael Fingleton legal bid to halt Central Bank probe opens

Mr Fingleton, along with several other former officials of INBS, are the subject of a Central Bank inquiry, which is due to commence hearings in February.

The Central Bank wants to inquire into allegations certain prescribed contraventions were committed by both INBS and certain persons concerned with its management, between August 2004 and September 2008.