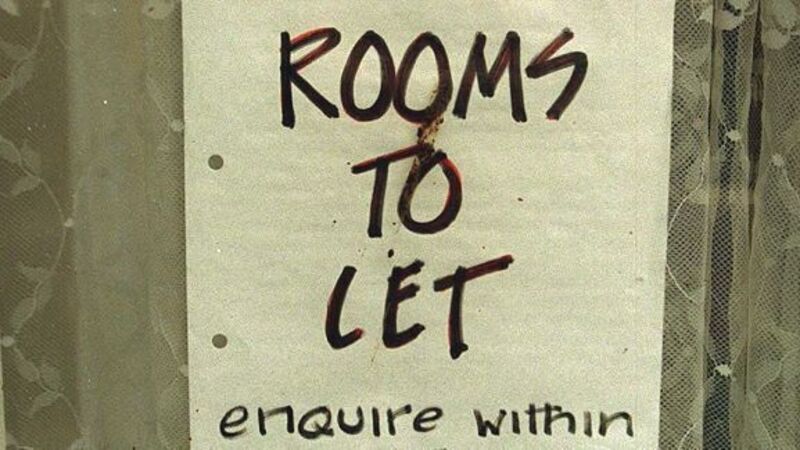

‘Dublin rent to keep rising’

Construction costs have been flagged time and again as the biggest obstacle to building homes in Dublin. Surging demand has seen property prices in the capital 11% higher than this time last year.

Irish Residential Properties REIT (IRES) is one of the firms benefiting from the shortages, however, as demand for rental property helped the firm build pre-tax profits of €14.8m — up from €5.8m last year.