Political ‘interference’ causes investor concern

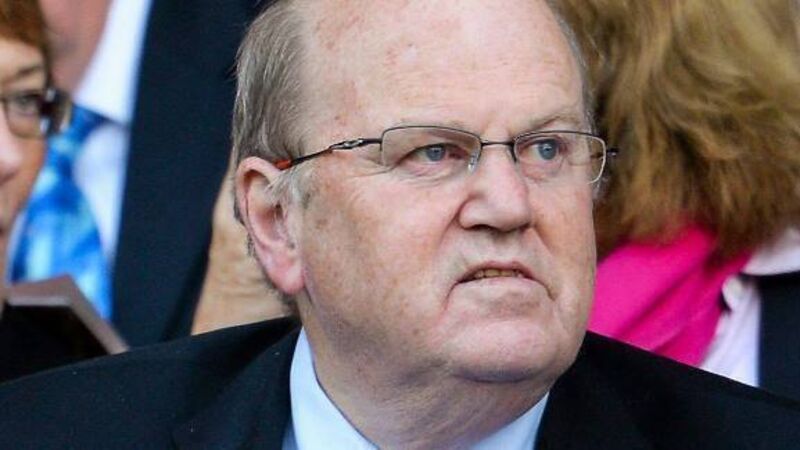

Finance Minister Michael Noonan said yesterday that following a round of meetings this week with bank chiefs, he has secured their agreement to lower their standard variable mortgage rates.

The Government would consider “a penal banking levy” or provide new powers to the Central Bank if the Department of Finance was not happy with the lenders’ actions in the coming months, the minister said.