Cuts in lending by RBS criticised

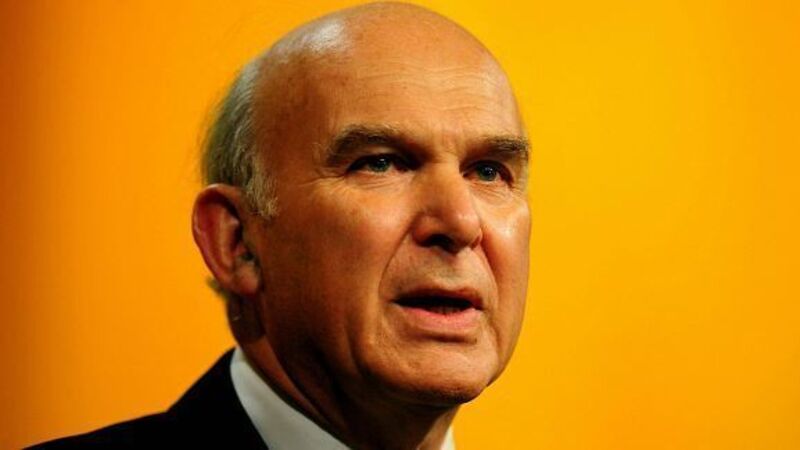

“Five years after the crisis, we still have more money being taken out by RBS particularly than being put in additionally” by Lloyds, Santander and some of the “new challenger banks,” Mr Cable said in a speech at the London Stock Exchange. “Using the big institutions as a lever to get creditinto the economy didn’t work.”

British policy makers want banks to lend more to help stimulate the economy. Accounting firm KPMG said this month the UK’s biggest banks cut lending to consumers and businesses by £364.7bn (€466bn) in the past five years.