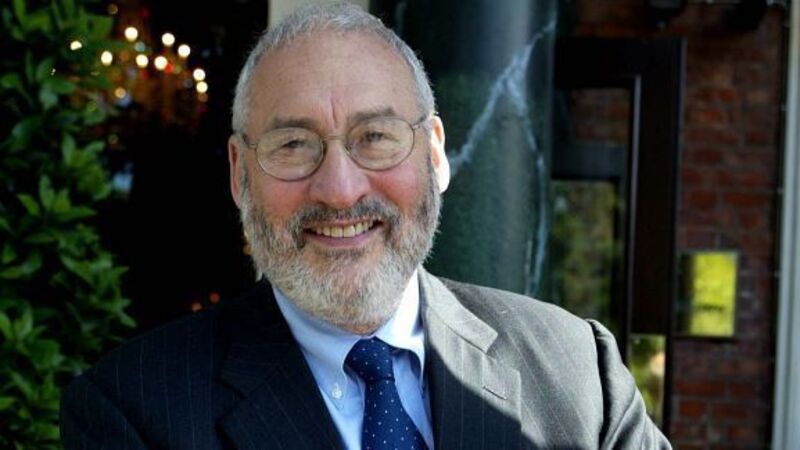

Stiglitz slams austerity as ‘a dismal failure’

The Columbia University professor, speaking on the sidelines of a conference in the southern German city of Lindau, said that high unemployment and sluggish growth underscore the shortcomings of the response to the turbulence that swept the currency bloc.

“Now we see the enormous price that Europe is paying,” Stiglitz said in an interview with Bloomberg Television.