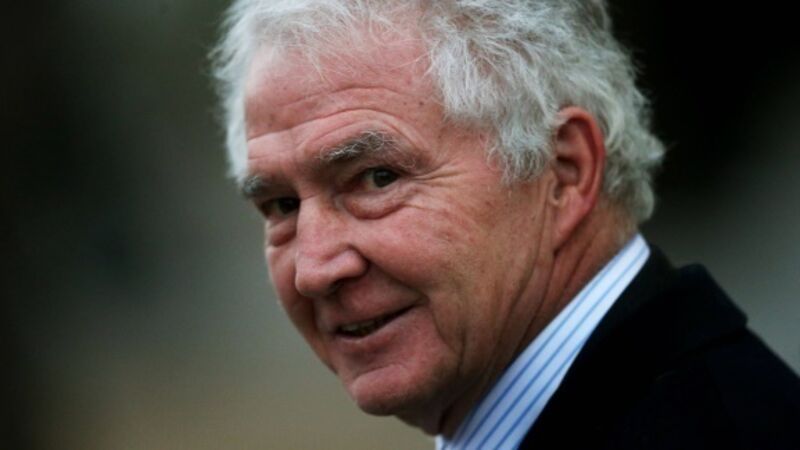

Former Anglo chairman to exit bankruptcy next month

Mr FitzPatrick was adjudicated by the High Court as a bankrupt almost four years ago, with debts of €147m and assets worth nearly €47m.

At the time of the adjudication, he would have expected to remain a bankrupt for 12 years.