John Whelan: Ireland faces ripple from new US rules targeting low cost packages

Reeling from US import rules targeting low value shipments, Chinese exporters have shifted focus to European markets, bringing worries they will dump products at prices that will force the closure of Irish businesses, large and small.

Reeling from US import rules targeting low value shipments, Chinese exporters have shifted focus to European markets, bringing worries they will dump products at prices that will force the closure of Irish businesses, large and small.

Since August 29, the United States removed the $800 (around €680) de minimis threshold for commercial shipments, effectively making all shipments liable for full import duty. This change affects the vast majority of Irish businesses exporting low-value goods to the United States, including items previously exempt from tariffs and duties.

The de minimis import rule allowed low value shipments to enter the US without incurring duties. This was particularly attractive for cross-border ecommerce.

For brands, it meant faster customs clearance, no additional costs for customers at delivery, and a smoother and more competitive buying experience. It’s no exaggeration to say that de minimis helped fuel the growth of global ecommerce across the globe.

The majority of delivery services to the US such as DHL, Fedex, DPD, and postal services scrambled to deal with the new rules and stopped accepting packages for a period. But collateral damage for Irish businesses and particularly retailers also arises as Chinese exporters try to offload their goods on markets outside the US.

Currently, imports to Ireland from China are running at around €1bn a month, which is 15% higher that the average per month last year.

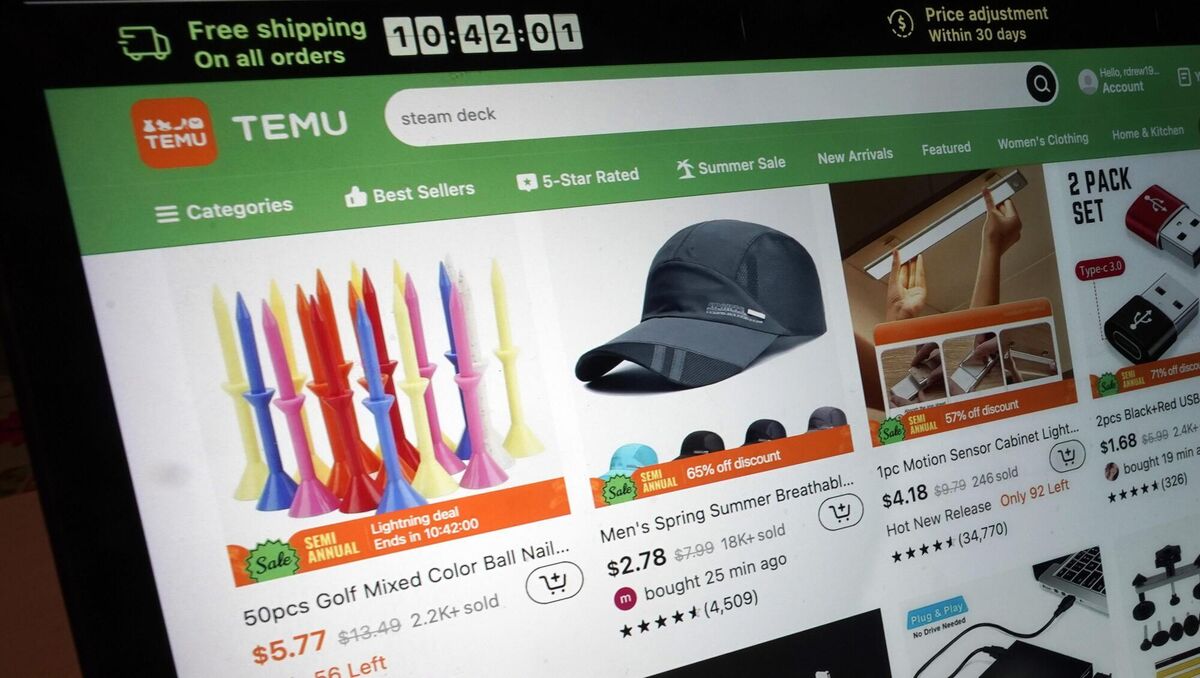

Irish exporters are also caught by the elimination of the tariff-free free for low-cost goods entering the US. But where Irish exporters will now have to pay a 15% import duty on arrival into the US, Chinese suppliers have to pay 120% import tariff shipping Stateside This has particularly impacted Chinese suppliers of low value goods, such as Temu and Shein and hence, the potential from renewed focus on open market countries such as Ireland.

US authorities have also blamed the success of firms like Temu and Shein for putting strains on border authorities, as the number of packages entering the US under the de minimis loophole surged from about 140m a decade ago to more than 1bn last year.

De minimis shipments accounted for over 90% of all cargo packages entering the US, according to the US Customs and Border Protection. Products sold under the exemption include clothing, footwear, accessories, and cosmetics.

Packages sent to the US from mainland China and Hong Kong with a value of up to $800 now face a 120% tax rate or are subject to a flat fee. The fee was $200 at the beginning of June.

Chinese manufacturers both online and off, have benefited from free of duty rules for low-cost goods entering Ireland and across the European Union, but the loophole may be closed soon.

In a move mirroring the US action, the EU has announced a review of low-value imports coming into the country and is planning to scrap duty-free exemptions for parcels worth less than €150.

Irish exporters are concerned that their largest market for low-cost shipments, the UK is also considering eliminating duty-free low-cost imports. The current rule allows Irish retailers to send packages to the UK duty free if they are worth less than £135 (€156).

British chancellor Rachel Reeves said the cheap import goods are "undercutting the British High Street and British retailers".

As the UK and US represent significant growth markets, a short-term strategy for Irish exporters maybe to absorb the cost of the added duties. But, as de minimis gets blown away by more and more countries, this may not be viable for most Irish exporters. For many, the best long-term strategy maybe to do localising fulfilment in the UK or the US. For scale-up brands, this approach can protect margins, improve customer satisfaction, and make international expansion more sustainable.

To protect themselves and reduce their cost exposure as de minimis loopholes get closed, most e-commerce platforms in China have mutually agreed to deactivate their "return without a reason" option on their international selling apps.

For consumers, the Association of American importers forecast a €30bn added cost per year for US consumers. And if the EU and the UK follow with the elimination of the low-cost duty exemption rule, then consumers in the UK and EU could also see prices rising.