The pension auto-enrolment clock is ticking

Pensions auto-enrolment: Employers can opt to utilise the State AE scheme or whether they will promote their own Occupational Pension Scheme for employees not currently in pensionable employment, advises Provest.

Provest director provides answers to the key questions being asked ahead of pensions auto-enrolment

The implementation of Auto-Enrolment (AE), under the name My Future Fund, will become a reality on 1 January 2026. The AE system marks a pivotal moment in pensions reform with far-reaching implications for employees and employers.

The objective of AE is to substantially increase the number of employees who are currently saving for their retirement, which will result in approximately 800,000 new savers. This is most welcome because our rapidly ageing population poses a considerable challenge to the sustainability of funding our pensions system.

A recent study from the Competition and Consumer Protection Commission points to the fact that 75% of all respondents plan to use the State Pension to fund/partly-fund their retirement. While there are currently four people working in proportion to the number of pensioners in Ireland, this figure is expected to fall to two working people to every pensioner by 2050.

- All employees aged between the ages of 23 and 60 who earn in excess of €20,000 per annum from all employments, and who are not already participating in a qualifying pension scheme via their payroll, will be automatically enrolled in AE.

- AE will use a similar model to the old Special Savings Incentive Account (SSIA) with employees making a contribution, matched by their employer and a government top-up equal to 1/3rd of the employee contribution.

- Contributions will start at 1.5% of gross earnings and will increase on a phased basis over a ten-year period to 6%. The maximum Gross Earnings that need to be referenced for contribution deduction purposes is €80,000.

- The Pension Fund Assets will be managed by three Investment Managers – Irish Life Investment Managers, Amundi and BlackRock. The scheme will operate a default investment strategy, which will be operated on a ‘lifecycle’ basis but employees will also have the option to choose from a range of alternative funds with varying risk levels (High, Medium and Low Risk).

- Employers will be permitted to use their own occupational pension plan (or a Personal Retirement Savings Account) to meet the auto-enrolment requirements.

- The definition of an employee covers all persons who are directly employed, including those on probation, working variable hours and seasonal workers.

- Auto-enrolment does not apply to the self-employed or those who pay Class S PRSI.

- Employees will be in a position to opt-out or suspend contributions after a mandatory participation period of six months

- AE will be run by a new Government body, the National Automatic Enrolment Retirement Savings Authority (NAERSA).

- NAERSA will use Revenue payroll data to identify eligible employees, using a lookback period of up to 13 weeks.

- NAERSA will send employers an automated enrolment payroll notification (AEPN) through payroll software in December 2025 for those employees identified as eligible. This will detail the employer and employee contribution amounts.

- Employers will have several options to pay the contribution amounts to NAERSA. The easiest way will be a variable direct debit, which can be set up through the auto-enrolment employer portal (expected to go live in December 2025).

With the launch of the AE system now only a matter of weeks away, and AEPN instructions due to be released in December 2025, it is imperative that employers immediately consider their AE strategy and employee readiness.

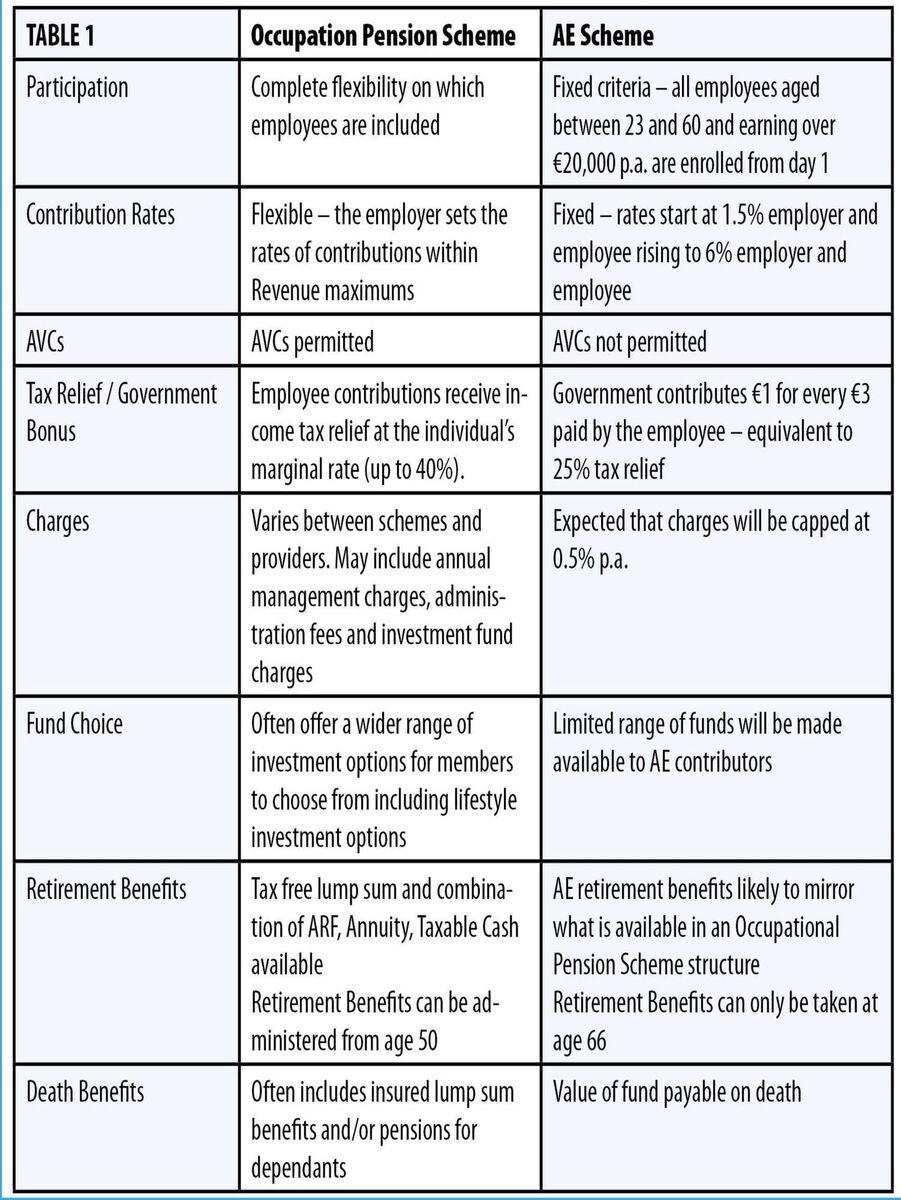

Employers will need to consider whether they will utilise the State AE scheme or whether they will promote their own Occupational Pension Scheme for employees not currently in pensionable employment.

The key differences between an and the can be summarised as follows:

The introduction of AE is a positive development and heralds a once-in-a-lifetime opportunity to narrow the gender pensions gap, significantly increase the number saving for their retirement, build a more resilient workforce and result in employees not being solely reliant on the state pension in retirement. It is now the time for Employers to assess whether the AE scheme or their Occupational Pension Scheme is the optimum solution for their employees and their business.