My Future Fund: Welcome progress, but not the full answer

The new auto-enrolment (AE) pension scheme, My Future Fund, will see many people start setting aside money for retirement for the first time.

People auto-enrolling into pensions schemes is a welcome start, but be sure to seek advice to ensure you're making the best possible investment to fund your retirement, advises , CEO, Acorn Life Group

Ireland’s new auto-enrolment (AE) pension scheme, My Future Fund, is due to launch on 1 January 2026.

It will apply to employees aged between 23 and 60 who earn more than €20,000 a year and are not already in a workplace pension scheme. These workers will be signed up automatically, with the option to opt out after six months.

A recent nationwide survey by Ask Acorn shows strong public support: 84% of adults believe auto-enrolment is fair and 87% of those eligible say they are likely to stay in the scheme once enrolled. For policymakers, these figures signal a major step forward in tackling Ireland’s pension gap.

The auto-enrolment system is designed to increase pension coverage, especially for the one in three Irish workers who currently have no private pension. Employer contributions and State top-ups mean that for many, Auto Enrolment will provide a valuable boost to retirement savings.

However, Auto Enrolment is not a one-size-fits-all solution. Contributions are set at fixed levels and may not be enough for higher earners, those with varied careers, or people who want greater flexibility or control over their investments. Younger workers are more likely to opt out – 37% of 18–24-year-olds say they may not stay in the scheme. Yet starting early, even with small amounts, can make a big difference over time.

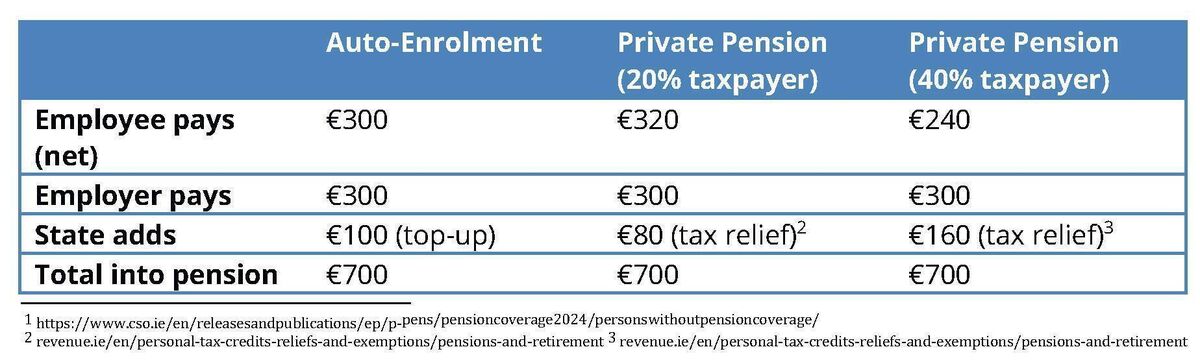

The table below shows the cost to an individual of a total contribution of €700, split between employee, employer and State/tax supports in the accompanying graphic.

While AE will suit some people, others may be better served by a private pension or their employer’s existing plan. Key points to think about include:

• Contribution levels – With no option for Additional Voluntary Contributions (AVCs) initially, will Auto Enrolment provide enough for the retirement you want, or should you save more elsewhere?

• Tax relief vs top-ups – Higher-rate taxpayers may find private pensions more cost-effective.

• Investment choice – Auto Enrolment has a default fund; private pensions may offer wider options.

• Financial advice – Auto-Enrolment does not include ongoing advice, whereas private pensions and company schemes may provide access to an advisor who can guide you through changes in your circumstances.

Auto-Enrolment is a positive step and long overdue. But it should be seen as the beginning of retirement planning, not the end. The survey shows a clear appetite for retirement saving, but also highlights the risk that some people may assume AE alone is enough.

For most workers, the safest approach is to treat AE as a foundation and seek advice on whether a private pension, PRSA, or company scheme might deliver a better outcome. With the start date now confirmed, the important thing is to engage early and make sure the pension path you are on truly matches your future plans.