Housing crisis and infrastucture need both public and private entity solutions

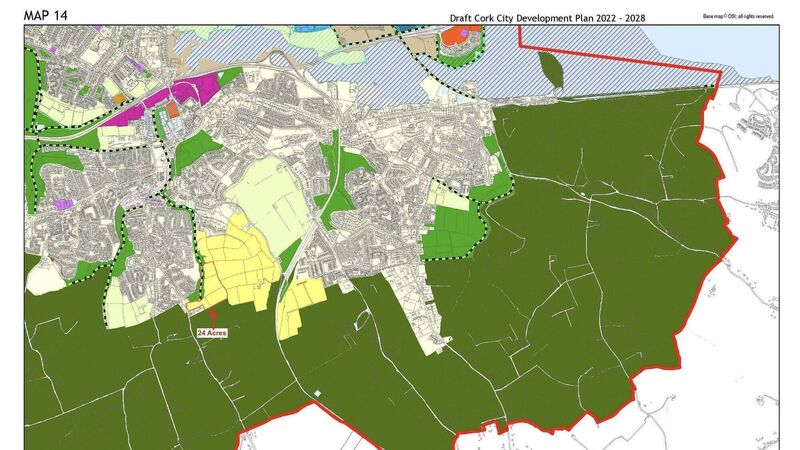

Treasure in them there fields? Zoning map for Castletreasure, Douglas, Cork where a c €10m land deal was in train in 2025. Rezoning submissions totaling over 3,000 acres were made to Cork local authorities last month

— Socrates

IRELAND has arguably gone through the most transformative period in decades in terms of planning and policy reforms that are targeting the residential development sector.