'Liberation Day' tariffs will have profound effect on Irish economy

The increased cost of exports to the US will have a direct negative effect on Irish business but the Trump tariffs will have a broader range of effects including pushing up costs to consumers and businesses in Ireland. Picture: Martin Meissner/AP

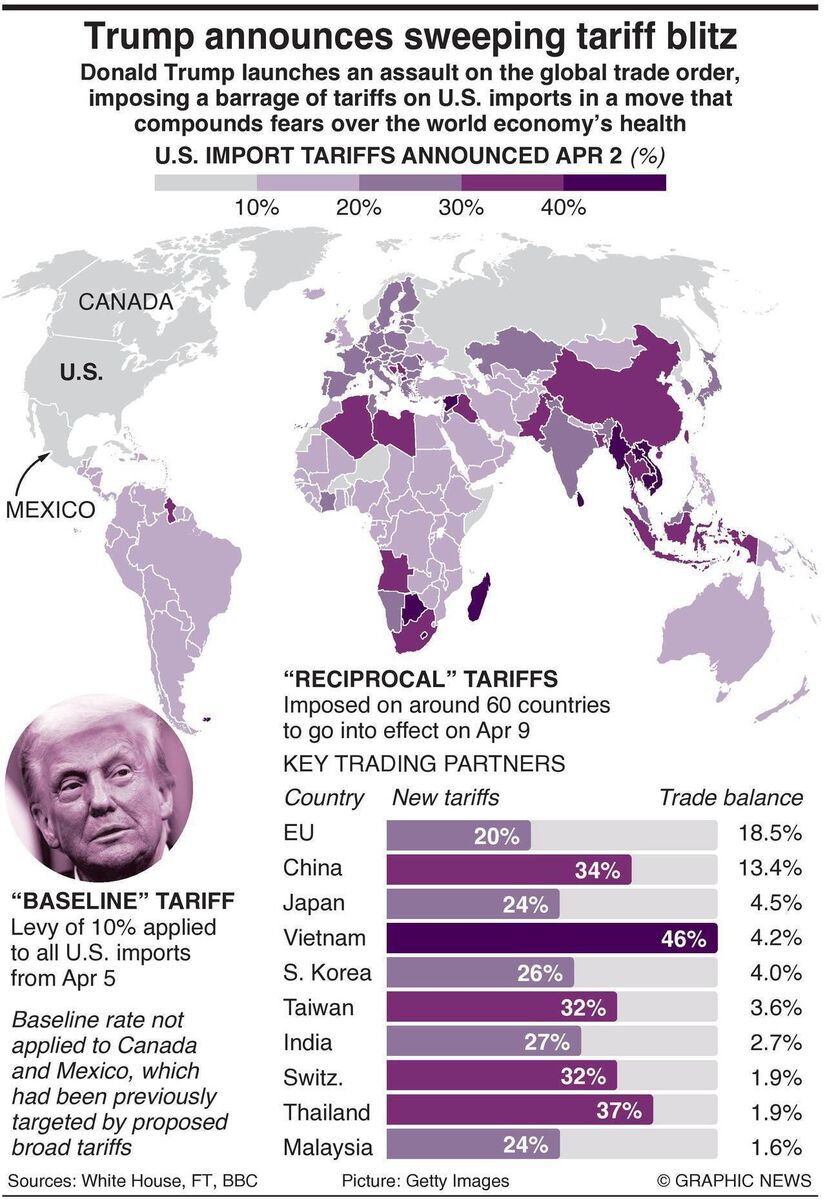

The impact of Donald Trump’s 'Liberation Day' tariffs announcement will be felt immediately in some areas but the knock-on impact on our jobs and industries will be deep and wide.

Whilst the effect of tariffs will impact on exports more than imports, tariffs are a zero sum game — that is, there are no winners. This is due to the fact that tariffs will be responded to by the EU in kind.

It’s likely the EU will now impose tariffs on imports from the US, leading to a direct increase in costs. Even without the imposition of tariffs on imports, this measure could still have negative effects for Irish consumers.

This is due to costs that affect companies operating in Ireland increasing. For example, pharma companies are likely to pass on their increased costs to Irish consumers. These increased costs for goods — inflation — can have further implications for ordinary people in the form of higher interest rates and other effects longer term.

The largest import category from the US by monetary value last year in Ireland was “other transport equipment”, the vast majority of which is aircraft.

Overall, this category accounted for 30% of all our imports — unsurprising, given Ireland’s concentration of aircraft leasing firms, as well as Ryanair, which uses Boeing planes and has ordered 300 new aircraft from the US manufacturer.

This could lead to an increase in the cost of flying for both holidays and business travel.

Whilst pharmaceuticals have initially been excluded from the tariffs, the fear is that the hit on these may be more specific and severe.

The issue here is that this is our most exposed area — Ireland exports up to €58bn in pharmaceuticals and chemicals to the US annually and, overall, some 32% of the country's total goods exports go to the US market.

The government fears the 20% imposition of tariffs (which is the expected rate) will potentially cut the exports to the US of pharma products by 50%. The total value of Ireland’s exports during 2024 stood at €223.8bn.

This was buoyed by a very strong performance in the pharmaceutical and medical sector which alone accounted for €99.9bn — of which almost €44.4bn went to the US. Pfizer, Johnson & Johnson, as well as Eli Lilly, all have significant operations here in Ireland and their primary export market is the US.

Companies like Kerry Group may not be as badly affected as expected despite having about €7bn in US sales in 2024. This is because it has a policy of producing locally that should protect against possible tariffs according to chief executive Edmond Scanlon.

Shares of companies linked to sectors that will be hardest hit by the new round of levies were sharply lower this week. The likes of Nike, Gap Inc and Lululemon all fell at least 7%.

They rely on goods and factories from Vietnam. Apple, whose supply chain is heavily dependent on China, declined 7.1%. Chipmakers such as Nvidia and Advanced Micro Devices were down, as were multinationals Caterpillar and Boeing.

In commodities, oil dropped, while copper, aluminium, and zinc all slumped as metals joined a rush from risk on fears that the sweeping new tariffs will end up crushing demand for industrial commodities. Gold rose after it was one of the few commodities exempted from the tariffs.

In terms of the cost to Irish jobs, there are around 50,000 people in Ireland working in pharma and the uncertainty and increased costs created by tariffs will very likely cause jobs to be cut and lower bonuses.

This may mean greater fear of redundancy, causing some employees to look at roles in other industries, in turn leading to lower pay. Given the high salaries and spending power of many of these employees, this could have a significant knock-on effect on the Irish economy. Additionally, many of the big pharma and tech companies provide lucrative share options for staff, but dropping share prices and smaller bonuses overall will reduce the value of these.

- Nick Charalambous is managing director of Alpha Wealth and the opinions in this article are his.