Businesses to receive energy-cost payments in December

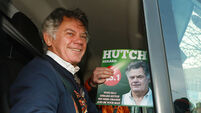

Finance Minister Paschal Donohoe speaks to media following the publication of the Finance Bill 2022 at the Whitaker Room, Department of Finance, Government Buildings, Dublin. Picture: Gareth Chaney/ Collins Photos

Hundreds of thousands of businesses will receive payments in early December under a new scheme to protect companies from spiralling energy costs.

Publishing the Finance Bill, minister Paschal Donohoe said the scheme will be open to businesses including shops, hotels, Montessori operators, accountants, and GP surgeries that have been hit by significant increases in electricity and gas prices.