Boy injured at birth seeks to treble damages to €61m

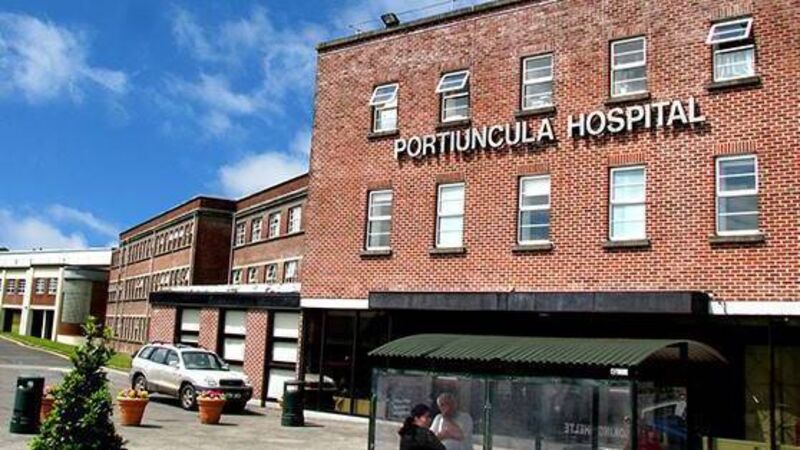

The case arises from injuries suffered by Oran Molloy during his birth at Portiuncula Hospital, Ballinasloe, Co Galway, on December 31, 2006.

The HSE has failed in a High Court application to adjourn a significant action next week by a catastrophically injured boy for orders seeking to treble the value of his special damages claim to €61m.

Oran Molloy’s case, in which liability has been admitted, has "fairly far-reaching" implications for similar cases, Patrick Hanratty SC, for the HSE, told High Court president Ms Justice Mary Irvine.