Trump tariffs: 'No sign of shock to Irish property market'

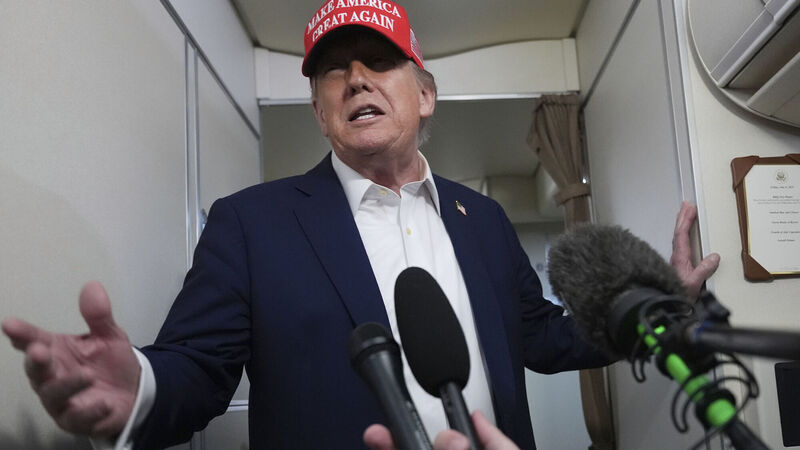

US president Donald Trump speaking to reporters on board Air Force One on Friday. Despite a warning from MyHome earlier this year, the US-EU tariff wrangling has not impacted the Irish homes market. Picture: Jacquelyn Martin/AP

A much-feared economic shock to Ireland’s property market by Donald Trump’s tariff policies has failed to materialise.

Earlier this year, MyHome had warned the speed at which house prices are increasing could be slowed by the prospect of a tariff war between the US and the EU.