Companies face huge loss of business due to Brexit tourist Vat measures

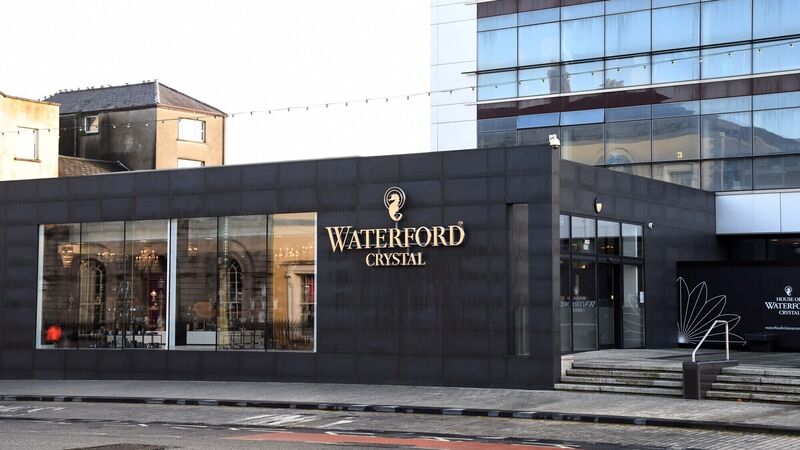

Waterford Crystal could face a loss of US sales. File picture: Denis Minihane

Companies such as Waterford Crystal stand to lose huge amounts of business due to a provision in the Government's Brexit omnibus bill, the Dáil has been warned.

Under the bill, the Retail Export Scheme, which allows non-EU tourists to claim Vat refunds on gift items purchased here, will rise to €75. Cabinet last week agreed that figure as a compromise to the proposed higher amount. It had been proposed that all tourist gift purchases costing under €175 be excluded from the scheme due to the fear it may be abused after Brexit.