Social Justice Ireland calls for new 'social contract' from Government

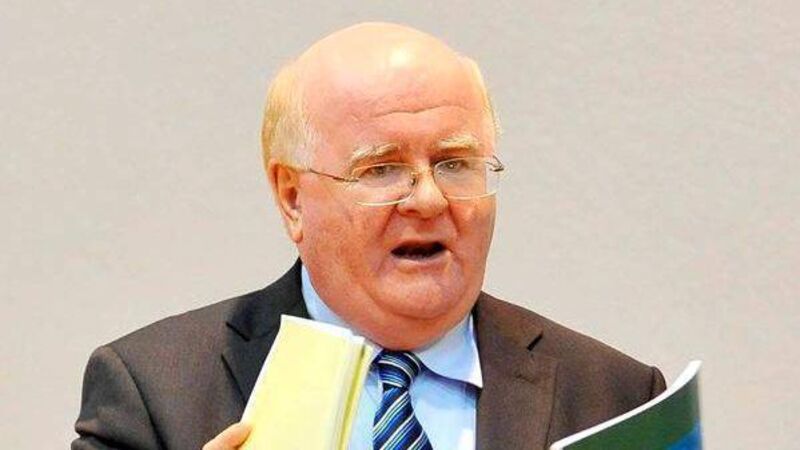

Social Justice Ireland director Sean Healy says the Government must not 'repeat the mistakes of the past'. Picture: Denis Minihane

An extra €3bn in taxes must be raised in various ways, including an effective minimum rate for corporations, in order to get a long-term recovery under way, according to a new policy document from Social Justice Ireland.

The anti-poverty agency also recommends that one fifth of all new homes built should be for social housing and that all costs associated with the pandemic be ringfenced so as not to impact on spending in a recovery.