How will the Budget affect you?

The Department of Finance has released its calculations on how different sample individuals will be affected by today's Budget.

The budget included a cut in the top rate of income tax from 41% to 40%, and increase in the standard rate band of €1,000, and a change in USC bands and rates.

According to the Department, Budget 2015 will affect the following groups as follows:

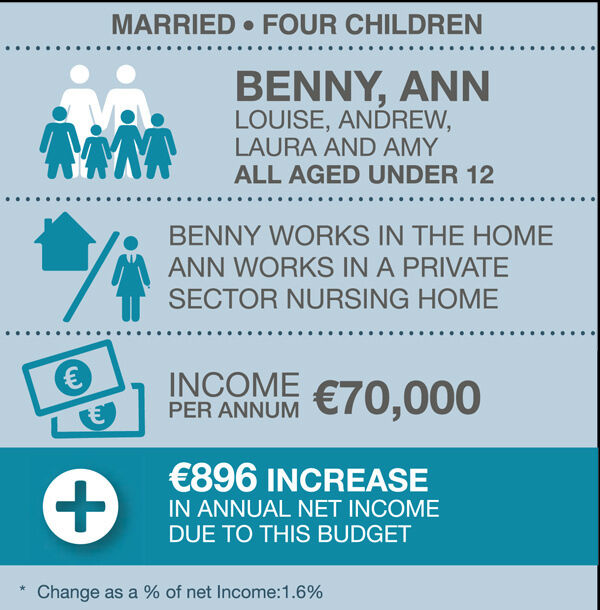

Married couple, one income (private sector)

• A married couple with four children and one income from the private sector of will be better off by (€17.23 / week).

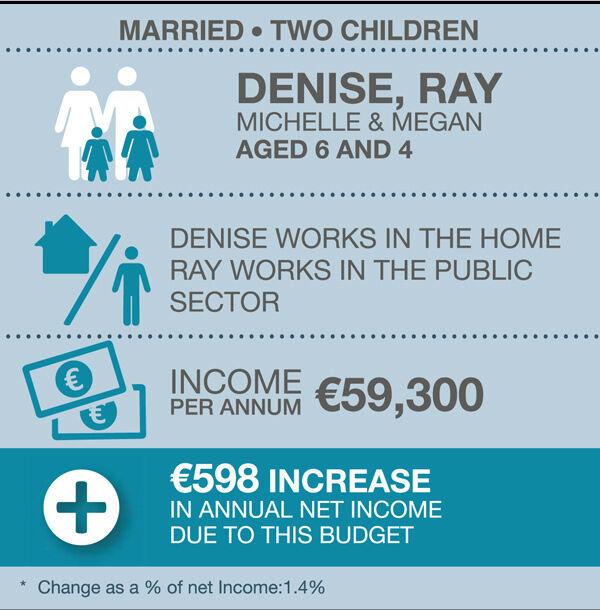

Married couple / one income (public sector)

• A married couple with two children, with one income in the public sector of will see an annual increase of (€11.50 / week)

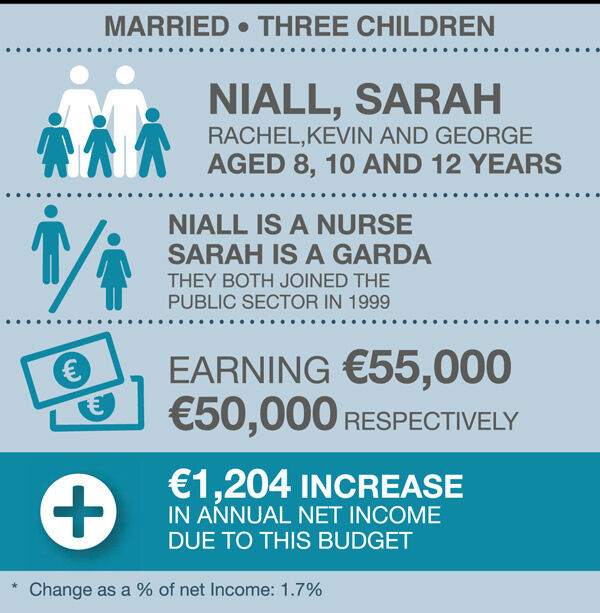

Married couple, two incomes (public sector)

• A married couple with three children, with a combined income from the public sector of (€55,000 + €50,000) will see an annual income increase of (€23.15 / week).

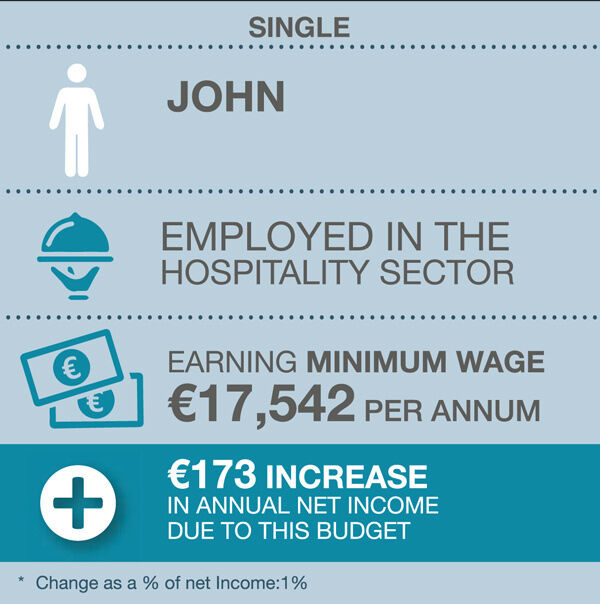

Single person, minimum wage

• A single person working in the hospitality sector on minimum wage () will see an increase of per year in income (€3.33 / week)

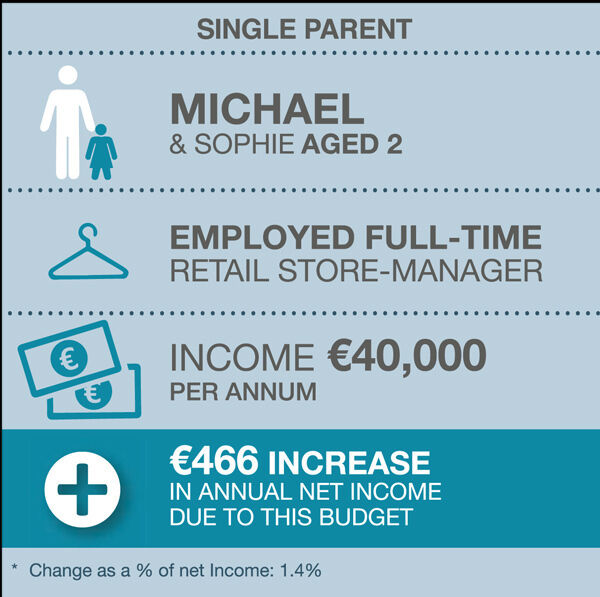

Single parent

• A single parent with an income of €40,000 will receive an extra €466 annually (€8.96 / week)

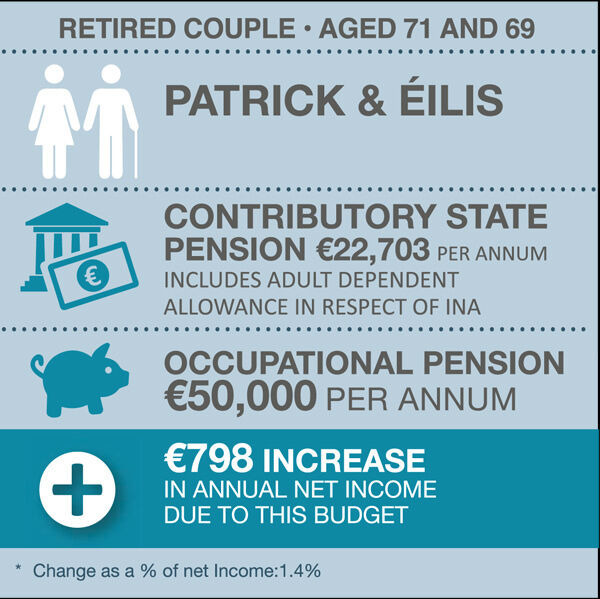

Retired couple

• A retired couple on a contributory state pension of €22,703 PLUS their own pension from employment of €50,000 per year will see €798 more per year (€15.35 / week).

These figures, it should be noted, do not take into account charges levied outside of the taxation system, including water charges.