Experts criticise Government's new mortgage initiative

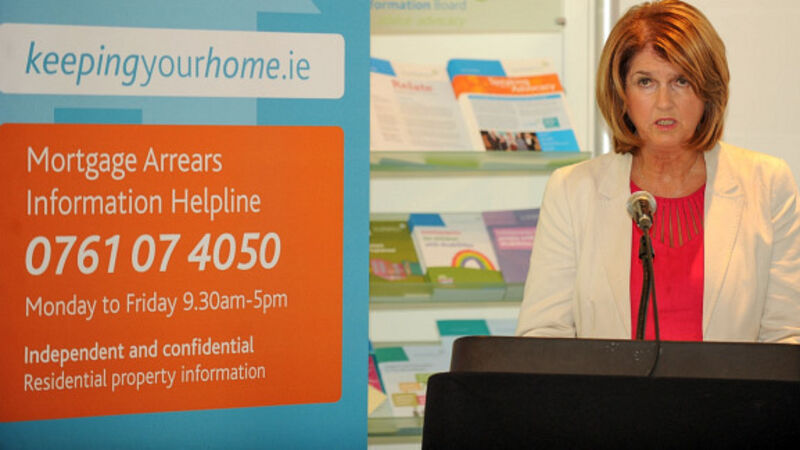

A new Government scheme offering free financial advice to struggling mortgage-holders has come under attack today.

Legal experts have claimed the initiative is not in the borrower's best interests as appointed accountants can only give advice on bankers' proposals on arrears.