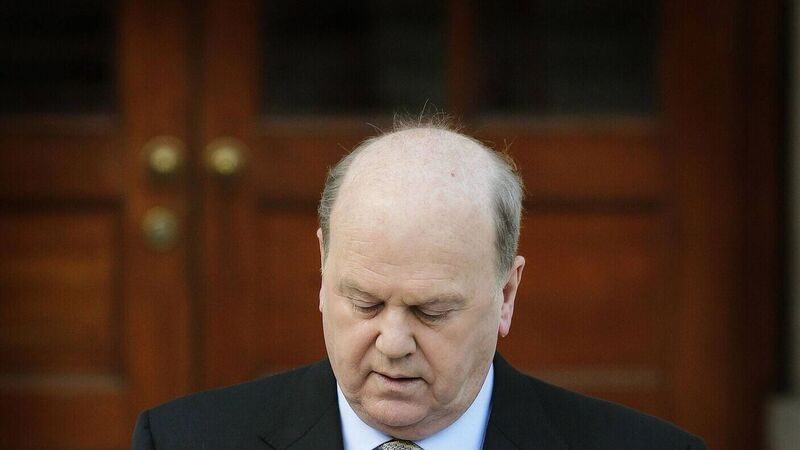

Noonan gambles with new tax rises

The Government has taken a gamble on economic recovery after unleashing a slew of indirect taxes hitting every aspect of daily life.

With vulnerable families and the disabled reeling from multi-million euro benefit cuts, shoppers, motorists, savers and investors were hurled into the firing line of tax hikes.