Family finances showing signs of recovery

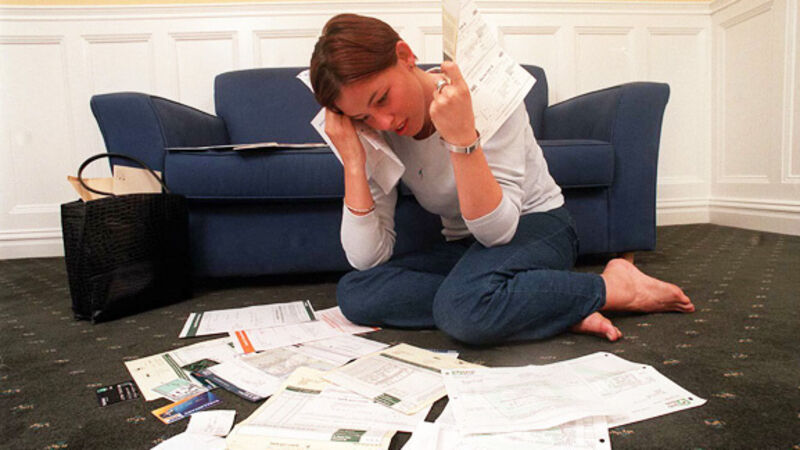

However, nearly four in 10 people are putting off paying their essential bills on time — up 32% since last December. Most of those sacrifice spending in other areas to pay their bills — health insurance and the grocery spend are most sacrificed.

Nights out, holidays, and clothing and footwear are the most sacrificed non-essential items. Consumers are also concerned the rising cost of motoring could force them to give up their car.