Consumers query 1% fall in cost of living claim

Consumers could be forgiven for questioning the validity of such a figure, based on personal experience of prices over the past five years.

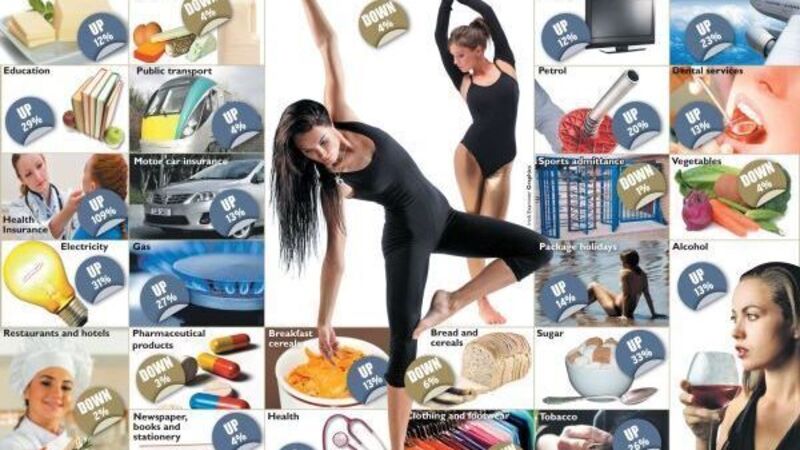

An analysis by the Irish Examiner of the Consumer Price Index published by the Central Statistics Office shows the general price of everyday goods and services has decreased by around 1% since the summer of 2008.