Insurers unlikely to sue ESB over floods

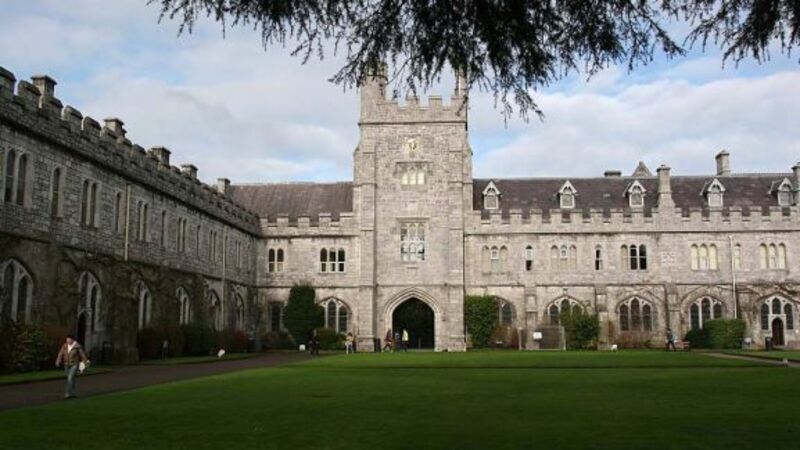

Despite the decision by University College Cork (UCC) to sue the ESB for €18m in damages, the Irish Insurance Federation (IIF) does not envisage its members taking similar action, an Oireachtas committee heard yesterday.

An estimated €150m in property damage occurred after the ESB released millions of litres of water from its Inniscarra Dam on the River Lee in Nov 2009.

UCC claims the ESB was negligent and caused severe flooding by releasing too much water in too short a time from the dams.

Addressing the joint committee on environment culture and the gaeltacht, Kevin Thompson, IIF chief executive, said the organisation had no knowledge of any of its members taking acton against the ESB.

“It would be a decision for each individual insurer but our sense is that they would not see it as their role to take legal action,” he told Cork TDs Billy Kelleher and Jerry Buttimer.

“With regard to the ESB, we as a federation have not taken any action and I do not know of any of our members who has.

“It is debatable whether it is the role of the insurance company to take that action or whether there are other appropriate authorities to take on that role. We are insurance providers. We are here to assess risk and to provide coverage where we can.”

The committee was meeting representatives from the IIF about the difficulties in obtaining home insurance for properties in areas that have experienced extreme weather events.

“The Irish insurance is quite competitive, with 12 major insurers in the market and insurers are acting prudently and fairly,” he said.

The IIF also defended its controversial practice of geo-coding, a mapping system that critics say is often inaccurate and can leave vast swathes of townlands uninsurable, despite no history of flooding.

Michael Horan, non life insurance manager of the IIF, said: “Geographical location is an important rating factor. The Geo-directory gives exact geo-codes for each building. Without it, it would be presumed that all properties within a geographical area are at equal risk of a flood. Geo-coding enables insurers to see, for instance, that one side of a street is in a flood risk area while the other side is not, instead of blanket exclusions. It allows insurers to see what buildings are in a flood hazard area and what buildings are not.”

He said the industry was in receipt of information from the Office of Public Works (OPW) with regard to remedial flood works and the new information would inform future decisions with regard to premiums.

“It will enable them to overlay the OPW information over the at-risk area and amend it to take account of the flood defence that has been built.”

Mr Horan said residents in flood hazard areas whose home were in an elevated position should make representations to their insurer in order for a re-assessment to be made of the risk.