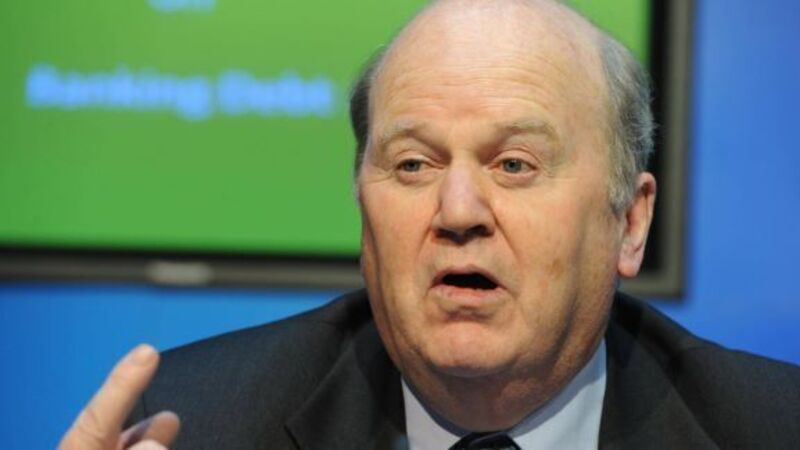

Noonan: Deal ‘best possible outcome’

He said the Government did not ask for a debt writedown: “The ECB does not give debt writedowns. We did not ask for what we couldn’t achieve.” And he rejected criticism that the overall stock of debt does not change because of this deal.

“I paid €3,200 for my house in 1968. When I paid my last mortgage payment 25 years later, my monthly teacher’s salary would have paid for my entire mortgage. That is what inflation does to debt,” he said.