The age of austerity

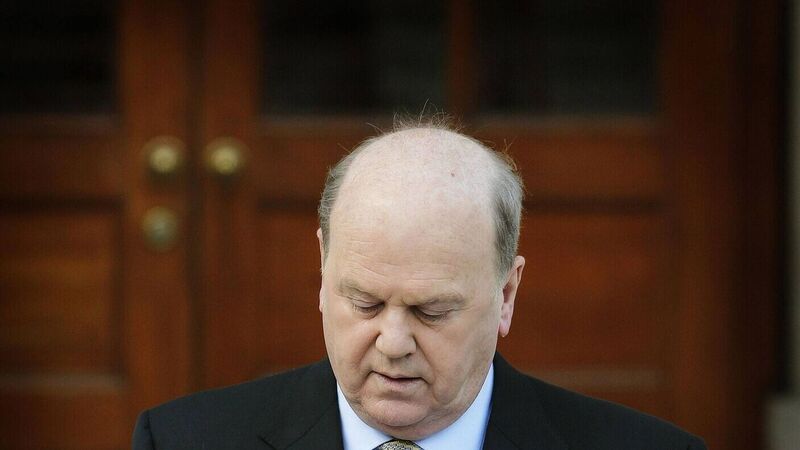

The Finance Minister took to his feet to deliver a well-crafted budget speech that claimed to soften the blow of harsh cuts announced by his coalition partners 24 hours earlier.

The maiden budget speech of a veteran politician managed to avoid mentioning any of the items that will define his first spending plan as Finance Minister: cuts to the disability allowance, reduced children’s allowance and fewer number of fuel payments for the elderly.