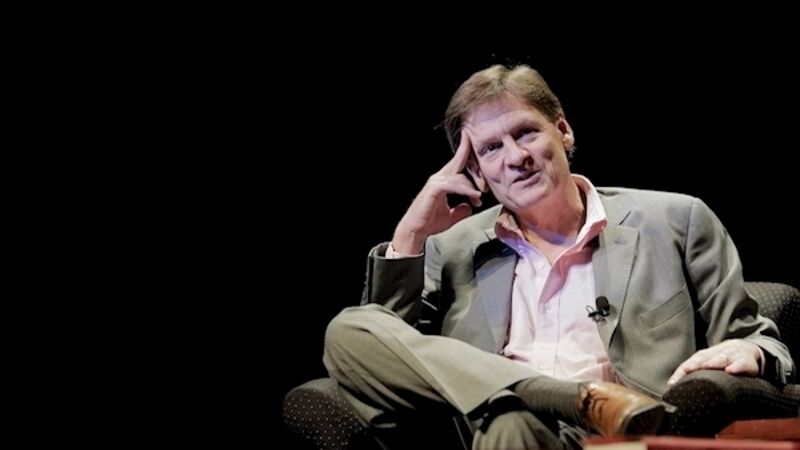

Moneyball author Michael Lewis examines the dangers of Trump in new book

Michael Lewis's latest book on America again produces a riveting read on what could be such a dry subject, writes .

It was just after 1am in the morning when the penny dropped that Donald Trump had won the race to the White House in November 2016.