Stay informed and stay ahead of the online fraudsters

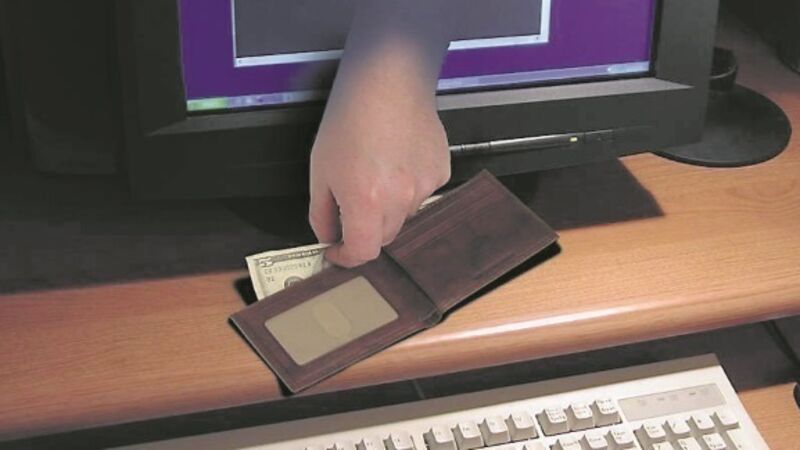

But the advances come at a price. The easier it is to move funds around, the easier it is for fraudsters to part victims from their money and online fraud is growing at an alarming rate.

Cambridge University lecturer Ross Anderson never banks online and he is the professor of security engineering at the university’s computer laboratory and an expert on cyber security. He refuses to do so because he believes the risk of fraud is too high and borne by the customers rather than the banks.