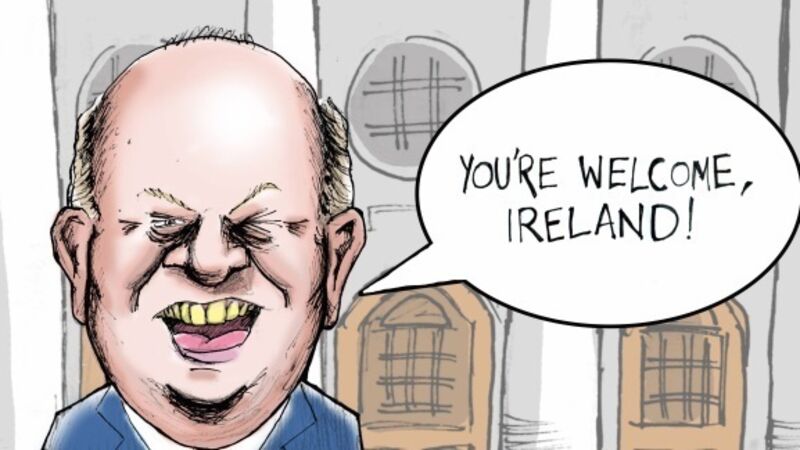

Kieran Coughlan: Message to farmers: borrow your way out of trouble

But it was almost unbelievable that there was no mention of general farming income volatility within the Budget speech, or the Budget documents.

Instead, they got augmentation of income averaging, will help farmers caught in the income averaging system facing high tax bills, but will do nothing to aid farmers outside of averaging, or assist farmer going forward in managing income volatility.