Dairy and pig prospects look better

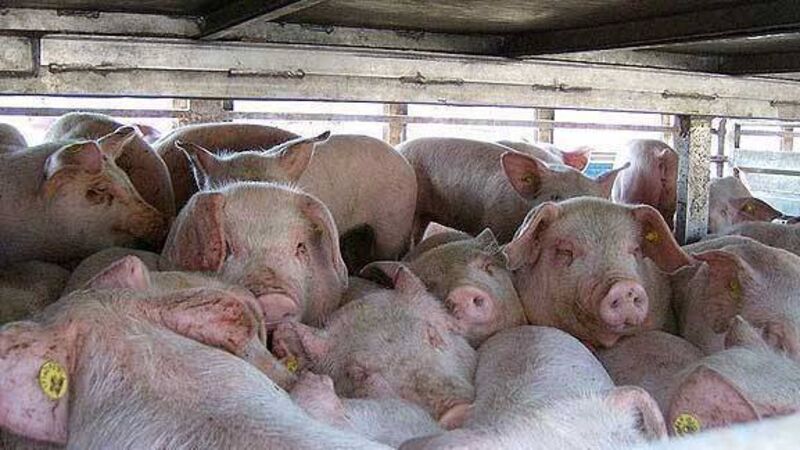

Insatiable demand from China for pigmeat has lifted EU prices 10% in a month.

And IFA sources have said a second successive GDT dairy auction price rise, and persistent if modest firming in EU commodity prices, suggest that the worst of the two-year dairy slump may have passed.