Q&A: ICOS 5-5-5 plan to protect dairy incomes, Martin Keane, ICOS

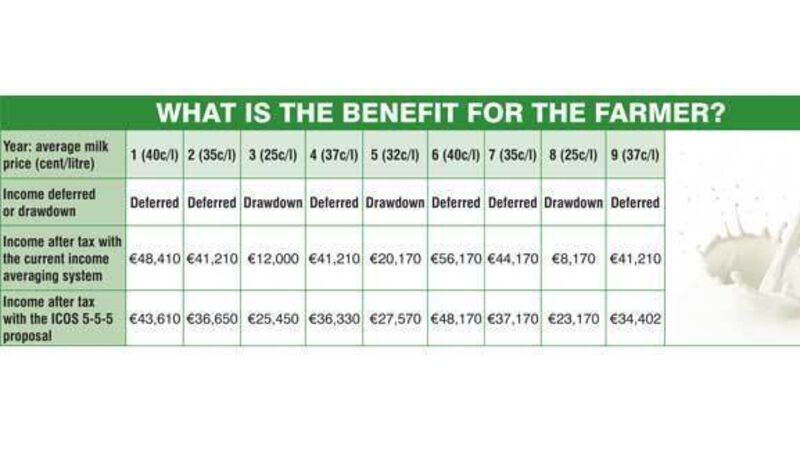

ICOS President Martin Keane said, “We have devised the “5-5-5” scheme in order to comply with EU state aid rules and we urge the incoming Government to address this matter in the programme for government and budget 2017.”

He said the co-op movement supported the milk price in 2015 to the tune of €100 million.