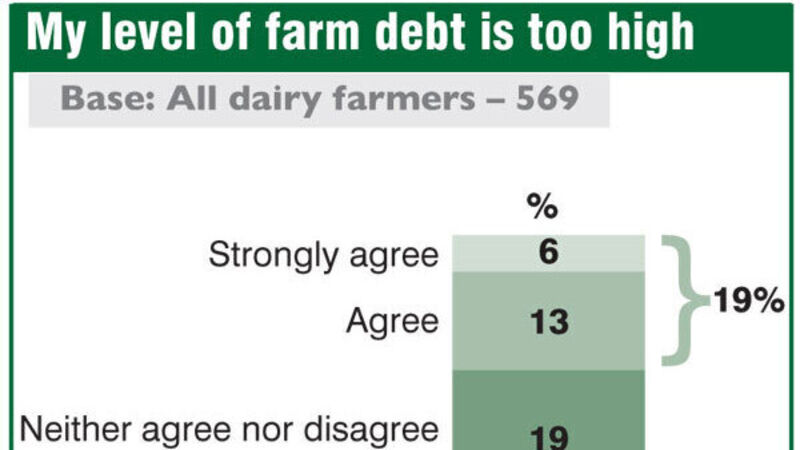

FARMING POLL 2015: Four in five say debts not too high

It’s one of the competitive advantages of farmers in Ireland that their debt levels are low compared to dairy farmers in Europe or elsewhere.

For example, our dairy farmers are relatively well placed, debt-wise, to make investments for expansion.